|

New Delhi, March 14: India’s headline inflation picked up in February on higher fuel costs but core inflation fell below 4 per cent for the first time in three years, reinforcing expectations that the RBI will deliver a rate cut next week.

Core inflation — which strips out food and energy statistics — will be a key number that the RBI will be poring over next week when it makes its mid-quarter assessment of the monetary policy.

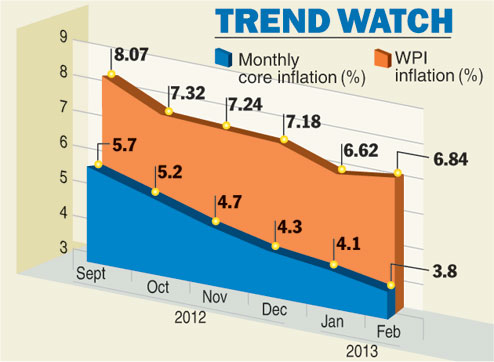

Core inflation fell to 3.8 per cent in February from 4.1 per cent in the previous month.

However, the wholesale price index (WPI) rose an annual 6.84 per cent in February, higher than the 6.54 per cent rise estimated by analysts, reflecting the impact of fuel price corrections by the government. Wholesale prices rose 6.62 per cent in January.

Core inflation is measured by excluding certain volatile and seasonal prices such as fuel and food. It takes the manufactured inflation without food and sugar to calculate core inflation.

“We believe the RBI will do a comprehensive and nuanced analysis of the economy and take the right decision and we hope it will vote for growth,” Arvind Mayaram, economic affairs secretary, said.

He said the rise in WPI-based inflation was largely because of food inflation. “But if you remove the element of food from the calculation, then actually it has come down,” Mayaram said, adding food inflation was “worrisome” and it was necessary to look at it.

PMEAC adviser C. Rangarajan said, “As of now, the numbers provide some comfort for the authorities to move in the direction of easing.”

Devendra Kumar Pant, chief economist of India Ratings, said the RBI might gradually ease the monetary policy given the decline in core inflation. The agency expects it to cut policy rates by 25 basis points (bps) next week and by 50bps-75bps in 2013-14.

CARE Ratings also feels the RBI is expected to support market sentiments and go in for a rate cut.

“Even though input prices have risen because of a weak rupee and rising fuel costs, corporate houses have been unable to pass on the cost increases as demand has weakened. This is captured in the declining core inflation,” said Sunil Sinha, principal economist, Crisil Research.

Bhupali Gursale of Angel Broking said, “This (lower core inflation) should give the RBI some elbow room to ease rates. But rate cuts going forward are likely to be limited by upside risks to inflation and the current account deficit.”

“There has been a continued moderation in manufacturing and core inflation for the sixth consecutive month. These factors, amid downside risks to growth, reinforce our call of a 25 basis point cut in the repo,” Shubhada Rao, Yes Bank chief economist, said.