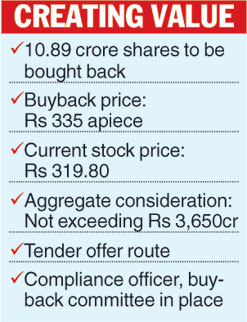

Calcutta, July 11: Public sector miner Coal India has announced a buyback of 10.89 crore shares at a price of Rs 335 per share for an aggregate consideration not exceeding Rs 3,650 crore.

Following a marathon meeting that continued late into the evening, the board of directors of Coal India approved the buyback of shares from all equity holders through the tender offer route.

The offer will not exceed 25 per cent of the aggregate fully paid-up share capital and free reserves of the company as recorded in the audited accounts for the financial year ended March 31, 2016.

The buyback is subject to approval from shareholders and other regulators.

"The board of directors noted the intention of the promoter of the company (central government) to participate in the proposed buyback," said a statement from Coal India to the National Stock Exchange. Government holding in Coal India was at 79.65 per cent as of March 31, 2016.

The statement added that the board has constituted a buyback committee and delegated powers to the committee to deal with matters related to the buyback.

The board has also appointed a compliance officer for the buyback. Coal India scrips were up 2.60 per cent on the NSE at Rs 319.80 per share in anticipation of the buyback announcement.

A share buyback typically happens when the management believes that shares are undervalued and it can deploy cash reserves and improve stock prices. As of March 31, 2016, Coal India's reserves and surplus was at Rs 27,581.24 crore against Rs 34,036.71 crore a year ago.

The buyback route has been popular with private companies looking to improve their stock's performance on the bourses. Now the central government is also exploring this route to unlock value.

"Although Central Public Sector Enterprises (CPSEs) have been set for specific purposes, some of them are not able to deploy cash/bank balances for viable business expansion.

"In such cases, buyback of shares improve investors' confidence and is likely to help the company raise capital in the future when it requires funds for expansion. Thus, it supports their market capitalisation, which is in the overall interest of the company," the department of investment and public asset management said in a recently issued guideline on capital restructuring.

Union finance minister Arun Jaitley had announced in the budget of adoption of a comprehensive approach of efficient management in public sector enterprises by addressing issues like capital restructuring, dividends, bonus shares etc. The decision to explore alternate measures to unlock value of CPSEs also comes at a time when government has significantly fallen short of its disinvestments target in 2015-16. Against a target of Rs 41,000 crore, the revised estimate for the year was Rs 25312.60 crore.

As of June 30, 2016, central public sector undertakings constituted 11.73 and 11.83 per cent of total market capitalisation of Bombay Stock Exchange and National Stock Exchange respectively and Coal India had the highest market capitalisation among all CPSEs.