British American Tobacco (BAT) is going to sell 2.3 per cent stake in ITC Ltd for $1.36 billion to institutional investors as it looks to delivers on its commitment to invest in transformation, deleverage and sustainable shareholder returns

In a regulatory filing with the London Stock Exchange on Tuesday evening, the maker of Lucky Strike and Dunhill, said that its wholly-owned subsidiary Tobacco Manufacturers (India) Limited intends to sell the shares by way of an accelerated bookbuild process (“block trade”).

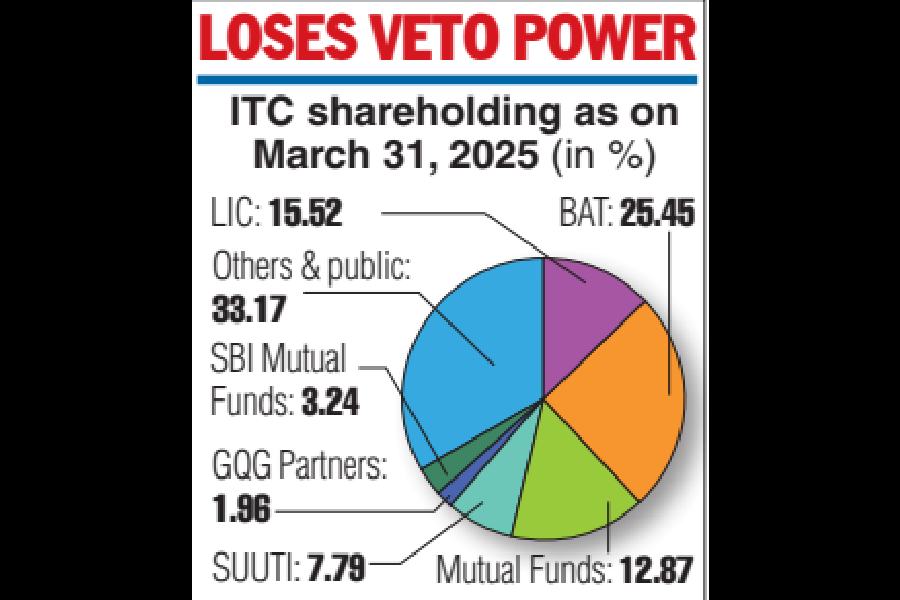

Following the transaction, BAT will continue to remain the largest shareholder of ITC, with a 23.1 per cent holding, down from 25.45 per cent it holds at present.

Commenting on the share sale, Tadeu Marrocco, chief executive officer of BAT, described ITC as a ‘valued associate’ which is present in an ‘attractive geography’ (India) with long term growth potential where BAT ‘benefits from exposure to the world’s most populous market.’

“Whilst this transaction supports delivery on our commitments to BAT shareholders, we continue to view ITC as a core strategic component of our global footprint as we partner on business opportunities in India. I am confident that ITC, under the stewardship of its current management, will continue to create further value for its shareholders,” Marrocco said in a regulatory filing to the London Stock Exchange.

ITC stock closed at ₹433.9 on BSE, down by 2.01 per cent or ₹8.9 a share. Sources said BAT could be offering shares at ₹400 a share, a discount of 7.8 per cent of from Tuesday’s close.

This is the second instance in as many years when BAT is selling shares in ITC. In May 2024, the London headquartered tobacco giant pared stake by 3.5 per cent to raise £1.6 billion, bringing down from 29.03 per cent.

Commenting on longstanding relations with ITC, BAT said the initial investment in the Indian company dates back to the early 1900s and the two companies have a longstanding, mutually beneficial relationship. “As one of India’s leading FMCG enterprises, ITC has delivered significant value for its shareholders,” it said.

With the proceeds of the stake sale, BAT plans progress to within the target 2-2.5x adjusted net debt/adjusted EBITDA leverage corridor (adjusted for Canada) by the end of 2026 and to continue with sustainable buyback programme by enabling an intended £200m increase in the share buyback to a total of £1.1bn in 2025.

Loss of veto power

With this round of stake sale, BAT is letting go of the veto power it enjoyed in ITC for decades by dint of its shareholding. According to Companies Act, 2013, a special resolution needed at least 75 per cent of votes polled in favour to pass such resolution. With a 23.01 per cent voting share, it would not be in a position to block special resolution anymore.

The importance of the veto was articulated by Marrocco on May 15, 2023, while speaking to Deutsche Bank’s Gerry Gallagher at the Global Consumer Conference.

“It’s important for BAT to have at least 25 per cent of shareholding in India. And the reason why I say 25 is because then we can keep board seats, we can have vetoing resolutions of the company, and we can try to steer the company to these opportunities that I was referring to.”

FDI Ban

As BAT goes below 25 per cent, Indian laws as it stands, would not allow the British major to claw back as and when required.

In response to a question by Gaurav Jain, sell-sideanalyst at Barclays, on Capital Markets Day on October 16, 2024, Marrocco outlinedthe predicament before the BAT board.

“We are quite happy with the shareholding we have in ITC. And we have to be mindful that there is a foreign direct investment ban in India, which means that if you sell, you don’t come back.”

Largest assets

ITC stake remained to be the largest assets on the balance sheet of BAT which has the twin goal of reducing debt and continuing with a share buyback programme.

Marrocco told Jain that the board would be ‘constantly reviewing the best way to deploy the assets that we have there (in ITC)’, adding that they provide ‘financial flexibility’ to the company.

“I’m not being dogmatic about ITC, but I’m just trying to put into perspective and from one side the attractiveness of the market, the fact that ITC is a fantastic company, from the other side, a very large stake for BAT and an important asset to keep financial flexibility for the group, underpinning all that, our efforts to get with ITC to unlock the shares,” Marrocco had said on Capital Markets Day.