The GST Council will convene on Wednesday with expectations of sweeping rate cuts to moderate consumer prices of food, auto and consumer durables, but the prospect of lower levies has sharpened tensions with Opposition-ruled states, many of which are demanding compensation from the Centre to cushion the impact on their already strained revenues.

The meeting follows the announcement by Prime Minister Narendra Modi from Red Fort on Independence Day, describing the overhaul in the 8-year old GST regime as a “Diwali gift” to the nation. The measures are aimed at boosting domestic demand at a time when the punitive tariff imposed by the US President Donald Trump on Indian goods exports is feared to inflict a slowdown in the economy.

At present, GST has a multi-slab structure with rates of nil, 3 per cent, 5 per cent, 12 per cent, 18 per cent, and 28 per cent, along with special rates of 1.5 per cent on cut and polished diamonds and 0.25 per cent on rough diamonds. Certain items also attract a cess, including tobacco, aerated water and luxury cars.

The Centre now proposes cutting down the number of primary slabs to two — 5 per cent and 18 per cent — alongside a 40 per cent special rate for demerit goods such as tobacco and luxury items.

The GST rate rejig follows a series of measures such as an income tax rebate announced in the budget and a 1 percentage point benchmark lending rate cut by the Reserve Bank of India to turbocharge the economy at a time when private capital expenditure remained sluggish, credit demand muted, and discretionary consumption weak. Lower GST rates could boost consumer spending, which, in turn, is expected to revive economic momentum.

Further, the current multiple slab structure has led to complex calculations and higher tax disputes. A simplified structure is expected to reduce evasion and widen the tax base, drawing more businesses into the formal GST framework.

As a precursor to the Council meet, the group of ministers from different states headed by Bihar deputy chief minister Samrat Choudhary met on August 21 and accorded an in-principle approval to the GST rate rationalisation.

While broadly agreeing with the slab changes, the GoM has favoured charging electric vehicles priced up to ₹40 lakh with an 18 per cent GST. The Centre, however, is keen to push electric vehicle adoption and favours a 5 per cent rate, and the same stance will be pushed in the Council meeting.

Expected changes

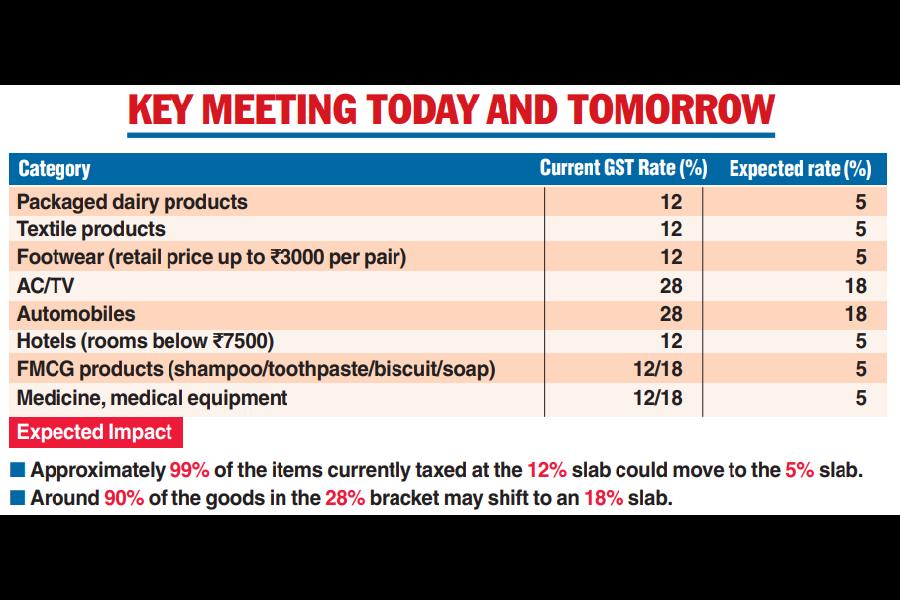

Most of the commonly used food items like ghee, nuts, non-aerated drinks, namkeen, certain footwear and apparel, medicines and medical devices are likely to move from the 12 per cent to the 5 per cent tax slab. Common use items, ranging from pencils, bicycles, umbrellas to hairpins, may also move to a 5 per cent slab.

Prices of electronic items like TV, washing machine and refrigerator are likely to fall because of being taxed at a lower rate of 18 per cent, as against 28 per cent currently. Four-wheelers that are currently charged 28 per cent, plus a compensation cess, may see differential rates; with entry-level cars being charged an 18 per cent rate, while SUVs and luxury ones being put in the special 40 per cent rate. The special 40 per cent rate will also be for other demerit goods like tobacco, pan masala and cigarettes. There could also be an additional tax on top of this rate for this category.

States’ concerns

The ambitious overhaul of GST could significantly lower prices across a wide range of goods and services, especially in FMCG, consumer durables, and electronics. With most goods moving to the 5 per cent and 18 per cent slabs, consumer-focused sectors stand to gain significantly as lower tax rates will boost purchasing power and drive consumption expenditure.

Eight opposition-ruled states — Karnataka, Himachal Pradesh, Jharkhand, Kerala, Punjab, Tamil Nadu, Telangana and Bengal — have supported the reforms but raised two key demands. First, states estimate a revenue loss of ₹1.5–2 lakh crore and want the base year for compensation fixed at 2024-25, with a five-year compensation window on account of the revenue loss. Second, businesses must pass on the benefit of GST rate cuts to consumers through an anti-profiteering mechanism.

At present, GST collections are shared equally between the Centre and the states. Additionally, 41 per cent of the Centre’s share is devolved back to states, meaning states receive about ₹71 for every ₹100 of GST collected.

Despite the apprehensions, an SBI Research report released on Tuesday expects states to remain net gainers. The estimated FY26 SGST revenue is ₹9.96 lakh crore, and the likely FY26 SGST revenue post-reforms is estimated at ₹14.1 lakh crore, including ₹10 lakh crore from SGST and ₹4.1 lakh crore via devolution.

Industry demand

While the GST reforms promise long-term benefits, industries are facing short-term disruptions with buyers postponing high-value purchases like automobiles, ACs, and mobile phones, anticipating price drops post GST changes.

Dealers and retailers are stuck with high inventories as dispatches slow down. Online platforms, which have also seen a slowdown in purchases, are preparing for a festive season boom in October once rates are formalised.

“Internal estimates suggest a 25-30 per cent impact on sales of high ticket segments like ACs, refrigerators, mobile phones on account of a delay in GST clarity,” said Naveen Malpani, partner and consumer retail industry leader, Grant Thornton Bharat.

The industry also awaits decisions on the correction of inverted duty structures, where GST on inputs exceeds GST on outputs. This anomaly often results in blocked working capital. Clear policies on refunds of input tax credits are expected.

The insurance industry is an example of this challenge. The GoM has proposed exempting insurance from GST altogether. Currently, insurance policies attract 18 per cent GST, but companies claim input tax credits on expenses like office rents and broker commissions. If GST is withdrawn, there will not be any input tax credit available and operational costs will go up. Insurers may pass the additional burden onto consumers via higher premiums.

Legal observers on Tuesday said that once the effective date of the new GST regime is notified, transitioning will lead to operational challenges, especially from overlapping transactions such as invoices raised before the change but goods delivered later and advance payments at old rates.