“Insurance broking is like any other financial or commodity broking services. The issue was recently discussed at a high level inter-ministerial meeting. The government is positively looking at the matter,” sources said.

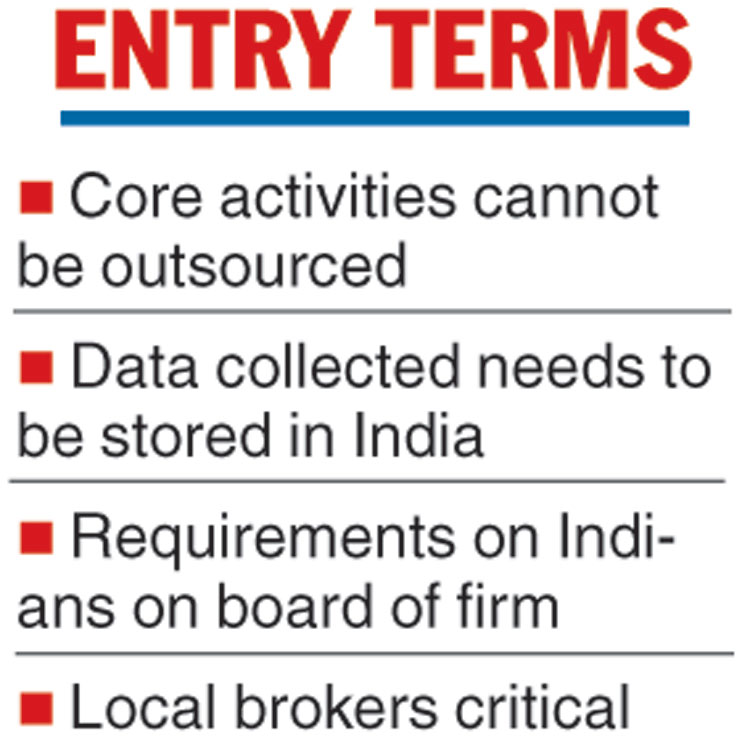

They said the increase in FDI will be subject to certain terms and conditions, like core activities, such as underwriting and claims management, cannot be outsourced.

Data collected in the country will have to be stored here and global offshore centres of companies within India can also be used for the purpose.

Minimum capital requirements could be raised as direct brokers, at present, have to maintain a minimum capital of Rs 50 lakh while a composite broker has to maintain a minimum capital of Rs 2.5 crore.

The Insurance Brokers Association of India (IBAI), however, opposed the government move to raise FDI from 49 per cent to 100 per cent in the domestic insurance broking sector.

Arvind Kumar Khaitan, vice-president of IBAI, said, “increase in FDI would be detrimental to the country

and increase in investment norms would not result in huge inflow of capital as the sector is more knowledge-based than capital-intensive….in the last 15 years, the liberalised FDI norm has resulted in 10 times the capital brought into the country by global insurance brokers have been taken out.”

The government is planning to increase foreign direct investment (FDI) in insurance broking to 100 per cent with certain conditions, including the number of Indian members on the board and the restriction on outsourcing of activities.

The FDI policy, at present, allows 49 per cent foreign investment in insurance that encompasses insurance broking, insurance companies, third-party administrators, surveyors and loss assessors as defined by the Department of Industrial Policy and Promotion (DIPP).

An insurance broker is an intermediary who acts as a middleman between insurance companies and clients to get them the most adequate cover at the best rate. In return, the brokers earn commissions for the product sold.

Representations had been made to the government time and again on the issue that insurance brokers should be treated on a par with other financial services intermediaries, where 100 per cent FDI is permitted.

The Telegraph