Erratic power supply and Net connectivity in the wake of Cyclone Amphan hit banking services in Bengal on Friday.

Operations at branches of various banks and ATMs were affected. Even digital banking, a key channel during the lockdown for bank customers, wasn’t smooth because of poor Net connectivity.

The bulk of the impact was felt at branches with an estimated 30 per cent of them remaining offline. There are 9,331 branches of public sector banks, private banks, foreign banks, payment banks, small finance banks and regional rural banks in the state.

The banks, though, could run critical back-end services to prevent a complete system collapse.

Operations were affected in parts in the districts of North 24-Parganas, South 24-Parganas, Calcutta, Hooghly, Howrah and East Midnapore.

Banks, according to officials, faced three major challenges — Net connectivity, power and accessibility to branches in places where road connection has been lost to uprooted trees.

Also, coordinating human resource was a challenge because of unstable mobile networks, they said.

“Most of the critical banking infrastructure is intact. It is just Net and power-related problems, which are a challenge at many locations,” Ranjan Kumar Mishra, the chief general manager of State Bank of India, said.

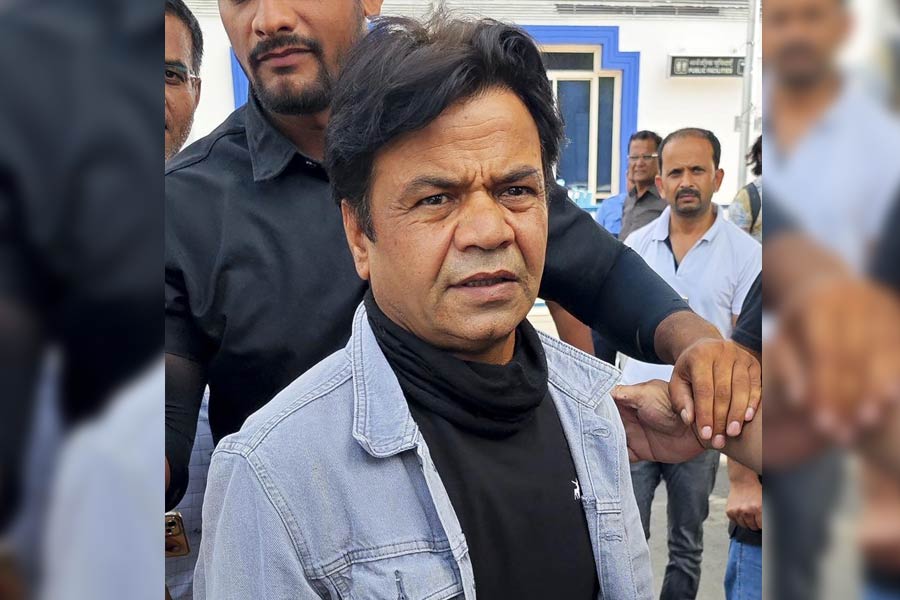

An uprooted tree in Chowringhee.

“Around 70 per cent of our branches are operational; we hope to get 90 per cent of our branches running at the earliest. We are in constant touch with service providers to keep the network running.”

The banks operations at the regional office on Strand Road was largely normal, Mishra said.

As part of the business continuity plan, places where branches are unable to operate, the nearest functional branch is being utilised to cater to the immediate needs of customers, he said.

Many customers and merchants were wary of using digital wallets, point-of-sale terminals and internet banking channels on Thursday and matters did not improve on Friday.

“Most banks have seen a surge in digital transactions in the past few months during the lockdown. But an unstable Net and an erratic power supply after the cyclone has added to the challenge,” an executive with a private bank said.

“Laptops and mobile hotspots are being used wherever possible to keep basic services operational. But we have to keep security in mind as well.”

Bandhan Bank, which has a major network in the state, has said close to 65,000 of its micro banking borrowers with a total exposure of around Rs 260 crore could be impacted because of the cyclone.

The affected portfolio is expected to regularise by the third quarter of 2020-21, the bank has said.

Chandra Shekhar Ghosh, the bank’s managing director and CEO, said the state administration was playing a key role in the recovery process.

At least 7-10 days will be needed for normal operations to resume, various banks have said.