|

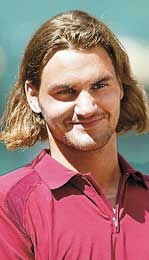

| Federer has no plans to quit Switzerland, says dad |

Zurich: Wimbledon champion Roger Federer has no plans to leave his native Switzerland in search of lower taxes or to avoid military service. “The goal is to remain in Switzerland,” Federer’s father Robert said in a telephone interview from the family’s home in Bottmingen, near Basel, on Sunday. “We don’t want to go to Monaco. Roger wants to stay in Switzerland.”

His remarks came after reports in the Swiss Sunday press suggested the 21-year-old, the first Swiss man to win a Grand Slam singles title, may relocate abroad because Swiss military authorities refused to excuse him from serving in the country’s civil defence forces.

According to Sonntags Zeitung, Federer has been declared unfit for military service but ordered to serve instead in the civil defence militia force.

Swiss law requires all Swiss males between the ages of 20 and 50 to serve either in the military or the 300,000-strong civil defence force, which is tasked with “protecting the public in the event of armed conflict”.

Federer indicated the family was negotiating with military authorities to find a solution for the tennis star, who would be unable to keep up his strict training regime if he was drafted to serve in the defence force.

“We’ll be able to find an agreement,” he said. “The military issue is always a problem in Switzerland, not just for Roger, but for other athletes as well.”

Federer also denied that his son was looking to move abroad in a bid to save taxes, but said he may move within Switzerland in search of a lower income tax rate.

“Certainly we’re trying to check on the tax situation,” said Federer senior, who works for a chemical company and helps manage his son’s affairs in his spare time.

Federer, who lost a marathon Swiss Open final to Czech Jiri Novak 7-5, 3-6, 3-6, 6-1, 3-6 in Gstaad, has won around $6 million in prize money in his career so far, a figure that is expected to increase drastically now that he has bagged the Wimbledon title.

Income tax rates in Switzerland differ widely across cantons (states) and even between communities within a given canton. Towns like Zug, in German-speaking central Switzerland, are famous for their low tax rates.

Other sports stars, such as German-born Formula One champion Michael Schumacher who lives in the western canton of Vaud, have clinched individual agreements with local tax authorities that provide for sharply lower tax rates.

But this option is only open to foreigners — or to Swiss who have been living abroad for at least 10 years.