Trinamul Congress MP Mahua Moitra, who has been spearheading the attack on the Adani group since long before US short-seller Hindenburg Research accused it of stock market manipulation and accounting fraud, said on Tuesday that market regulator Sebi’s affidavit to the Supreme Court was a clear case of“perjury”.

“It is absolutely unbelievable that India’s premier market regulator is so complicit with the Adani group that it lies to parliamentarians in writing saying it is investigating (the Adani group). Its bosses at FinMin (the finance ministry) lie in Parliament saying Sebi is investigating,” Moitra told The Telegraph.

Moitra told this newspaper that Sebi had informed her that it would be investigating issues relating to the Adani group.

“And then Sebi files an affidavit in SC saying it is not investigating. This is perjury,” added the Trinamul MP, who has been stinging in her attacks on the Adani group.

In its counter-affidavit to the Supreme Court — filed by a 22-year-old assistant manager posted in its Delhi office — on Monday, Sebi sought six more months to complete the court-ordered probe, passed in an order on March 2, 2023, in connection with the slew of allegations against the business conglomerate, levelled by Hindenburg in January this year.

The market regulator said the claims that it had been investigating the Adani group since 2016 were “factually baseless”.

Moitra, who had worked in Wall Street before stepping into politics, had raised specific questions regarding foreign portfolio investors in the Adani group in July 2021.

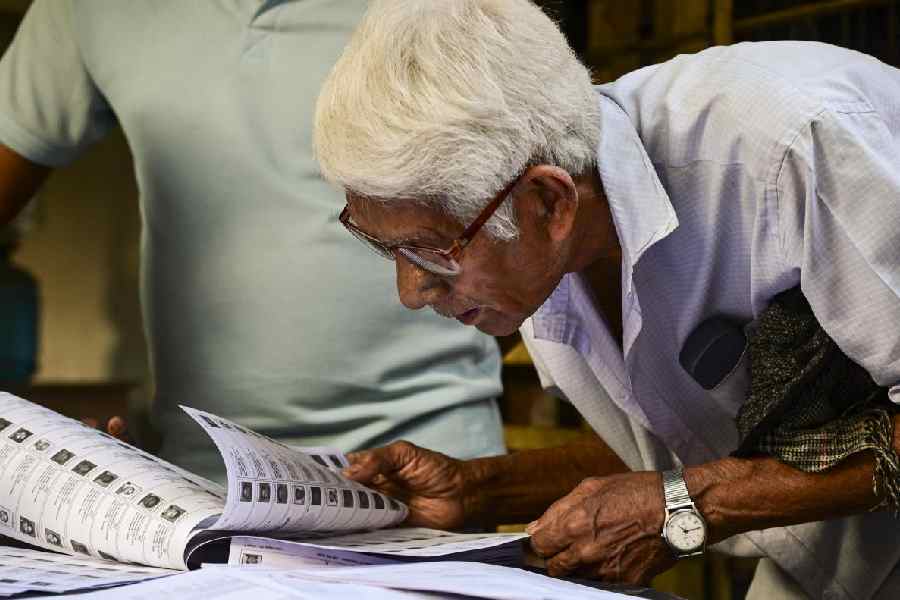

Besides, she had asked whether the “FPIs and/or Adani entities” were under investigation by Sebi, IT Department, ED, DRI or MCA for suspicious transactions. In her question, she had named three FPIs — Albula Investment Fund Ltd, Cresta Fund Ltd and APMS Investment Fund Ltd — and wanted to know whether they had been first on the frozen list of Sebi and then come out of it.

With her posers, Moitra sought clarity on the ultimate ownership of these funds — which were registered in the tax haven of Mauritius and together owned shares worth Rs 43,500 crore in four Adani companies — as the Adani group held stakes in strategic infrastructure sectors like ports, airports and power plants.

In a written reply on July 19, 2021, junior finance minister Pankaj Chaudhary said some Adani group companies were being examined by Sebi for compliance with securities rules as well as by the department looking at import and export taxes.

Moitra, who had been following up with the Centre on the Adani issue, had sent a letter to the then Sebi chief Ajay Tyagi seeking his “urgent attention” to two pivotal questions concerning “clandestine dealings of the Adani Group” and “defrauding its minority shareholders”. The attempts to draw the regulator’s attention to these “important issues” -- later on highlighted in the Hindenburg expose -- didn’t elicit any specific and concrete response, she had said several times.

Referring to the mismatch between what the minister had said in Parliament in July 2021 and Sebi’s affidavit on Monday, Moitra, who is now in Chicago, said: “Lying to the SC is perjury and so is lying to Parliament. This is utterly shameful. This Adani cover-up will be the end of Sebi and the end of the government. Mark my words.”

Because of the late hour in India owing to the time difference with the US, this newspaper was unable to elicit the views of Sebi and the finance ministry on Tuesday night. Their versions will be published when available.

Sebi’s request for an extension of the deadline for the investigation has surprised many as it had not initially objected to the two-month timeframe set by the Supreme Court on March 2, 2023, to complete the inquiry. The fact that Sebi has sought a six-month extension of the deadline — citing the need to understand “a complex web of transactions” and to “ensure carriage of justice keeping in mind the interest of investors and the securities market” — raised several questions.

Economist Prasenjit Bose said the affidavit captured Sebi’s “incompetence; at worse, a brazen cover-up”.

Bose also accused Sebi of stonewalling his two RTI applications — one on whether it had initiated any inquiry into Adani companies prior to the Hindenburg report and the other on the subscription and cancellation of the Adani Enterprises FPO.

“Sebi claimed in its responses that it does not possess such information and further, that these do not qualify as 'information' under the RTI Act.... It is clear that they have things to hide,” Bose told The Telegraph.

“In either case, Sebi should be asked to pack up,” he added.

Fuzzy issues

The market regulator had argued in its affidavit to the apex court that the petitioner Anamika Jaiswal, who had challenged Sebi’s plea for extension of the deadline for the submission of its report, had mixed up two different cases when slamming the regulator for failing to stop the three FPIs from routing overseas investments into the Adani group.

Jaiswal had claimed that Albula Investment Fund, Cresta Fund and APMS Investment Fund — all registered in Mauritius — owned shares worth Rs 43,500 crore in four Adani group companies: Adani Enterprises, Adani Green Energy, Adani Transmission and Adani Total Gas.

In June 2016, Sebi had frozen beneficiary accounts of several FPIs, including Albula, Cresta and APMS, after investigations revealed irregularities related to investments in the global depositary receipts floated by 51 companies.

The question that hung in the air was this: If the National Securities Depositary Ltd (NSDL) had frozen these accounts, how could these FPIs invest in the Adani group companies?

This is where Sebi has drawn a fine distinction between the GDR case and the funds flow into the Adani group. It said only the beneficiary accounts related to the GDR case were frozen.

No order was passed with respect to “other beneficiary accounts” of these three FPIs — a point that the finance ministry also made in response to a question raised by Mahua Moitra in the Lok Sabha in July 2021.

Sebi has claimed that the Adanis were not investigated in the GDR issue because they had not floated any GDRs. But this is a ridiculous argument; none of the 51 issuers, which included companies like Aptech, Birla Cotsyn, Lyka Labs and Morepen Labs, was investigated. It is the investors in the GDRs who were probed for the irregularities and not the issuers.

The strong links between the Adani group and Albula, Cresta and APMS raised suspicions whether the funds funneled into the GDR issues belonged to someone with close ties with the Gautam Adani group.

Controversy continues to cloud the entire issue because both the Narendra Modi government and the market regulator have been economical with the facts and thrown a cloak over the real details.