John Lennon once sang: The best things in life are free/ But you can keep them for the birds and bees/ Now give me money, That’s what I want. The message is clear and the gold rush is on with Bob Dylan to Bruce Springsteen, Paul Simon to Stevie Nicks turning in their catalogues for sacks full of money. Musicians of repute are talking about two companies — Hipgnosis Songs Fund and Primary Wave, both of which are turning the music business inside out.

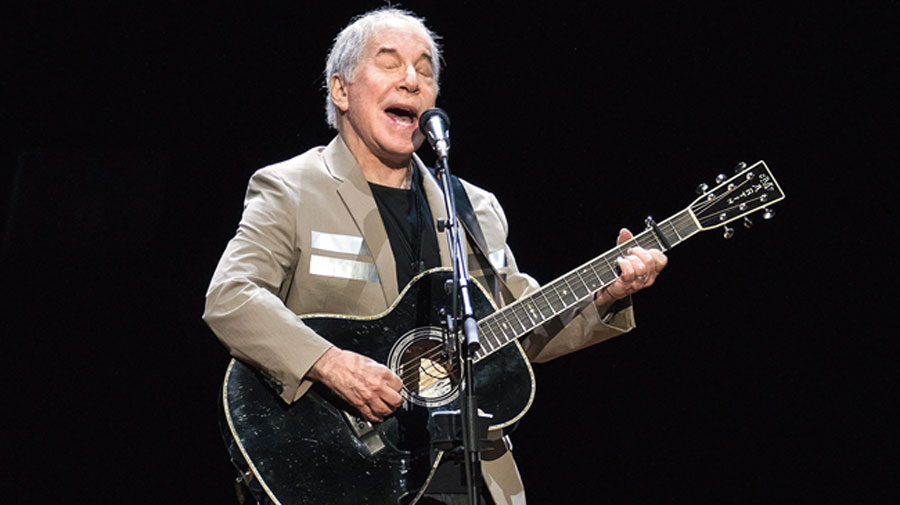

In the last two-odd years, a number of musicians belonging to the upper echelons of the pop-rock galaxy have queued up to take home more money than they could ever have thought of earning at one go. So far, we have heard Bruce Springsteen sell his music rights for an estimated $550m, Stevie Nicks has sold a share of her publishing rights for roughly $100m, Paul Simon’s song catalogue sold for a substantial amount, Shakira sold rights to her catalogue for an undisclosed amount and Bob Dylan sold his songwriting corpus for over $300m and then his master recordings for an estimated $200m.

Paul Simon (undisclosed amount)

Putting it into perspective

It’s confusing as to what they are selling and also the timing. It’s important to note that there are two distinct copyrights. There’s the song composition (the arrangement of the music and the lyrics), and there’s the tangible sound recording of the music (known as the “master”), meaning two streams of revenues. It also means that owners of both copyrights need to agree when it comes to licensing a song.

Let’s get this in perspective. Bob Dylan wrote and recorded All Along the Watchtower, which Jimi Hendrix later recorded and on its release, it became far more popular. If Jimi Hendrix’s version of the song is to be used in a movie, permission is needed of the song owner, which is that of Bob Dylan, and also from Hendrix or his estate or his record company — whoever owns the recording, an interesting explanation that was published by The Washington Post. (We are talking of Dylan’s permission before the man himself signed the deals.)

Companies that own both the masters and composition of a song can easily license the tune. And owning publishing rights of a composition helps with other revenue streams, such as mechanical royalties, paid — for example — “when a cover of an original song is recorded”.

Stevie Nicks: $100m (estimated)

Decoding the timing of the sale

Only in the last two-odd years we have been hearing about such sales. Why not earlier? Besides streaming services, new digital platforms — like TikTok or Instagram — are using music. So, all of these deals can become somebody else’s headache.

There’s more. Leave out Shakira and a few other younger musicians, most of the artistes who are selling their catalogues are ageing. Instead of leaving behind complicated publishing and copyright deals, it makes sense to leave behind a sizeable amount that can be invested and reinvested. It’s easier to work around with $500m than collecting small changes from here and there and then making up an investment fund.

Second, there’s a tax window in the US but it won’t be there forever. US President Joe Biden’s tax plans include changing US capital gains tax for the rich, so that it falls in line with income tax for any asset sale over $1 million, according to The Rolling Stone. It may increase the tax rate on the sale of a lucrative asset from around 20 per cent to around 37 per cent for the top earners. If Dylan or Springsteen sells now, they have to pay a smaller tax.

Shakira (undisclosed amount)

Next, consider other elements. Revenue growth from music streaming is slowing down in mature markets like the US and the UK. Nobody can ever be sure that something like Napster won’t ever happen to the music industry again. And will a musician remain popular after 20 years? These are valid concerns. (Napster made music piracy a reality, which was ultimately tackled by the arrival of music streaming that gave listeners access to millions of songs for a small amount.)

Hipgnosis Songs Fund and Primary Wave are two companies in the thick of things. Hipgnosis is traded on the London Stock Exchange while Primary Wave is backed by institutional investors. Merck Mercuriadis, founder and CEO of Hipgnosis, has been quoted in CEO Today: “If Donald Trump did something crazy, the price of gold and oil are affected whereas songs are not… [Songs] are always being consumed.”

All the deals highlight the gorge that separates the top one or two per cent of musicians from the rest in the streaming era because only the top names are benefitting from streaming income, which is miniscule. What happens to the rest, those who have only a handful of “hit” songs that will feel the nudge as more and more new recordings get dumped on streaming services?

Bruce Springsteen: $550m (estimated)

A ready reckoner

• There are two distinct copyrights — the song composition (the arrangement of the music and the lyrics) and there’s the tangible sound recording of the music (known as the “master”).

Companies that own both the masters and composition of a song can easily license the tune.

• There’s a tax window in the US but it won’t be there forever. US President Joe Biden’s tax plans include changing US capital gains tax for the rich.

• Hipgnosis Songs Fund and Primary Wave are two companies in the thick of things.

• The deals are being mainly struck by artistes who belong to the top one-two per cent of the music industry.