|

Vijay Jain is convinced that diamonds ? not gold ? are an Indian woman?s best friend. Eight years ago, Jain?s Intergold was an early mover in the branded jewellery business and its stand-alone stores were dazzling invitations to would-be buyers. Four months ago, Jain turned from gold to diamonds. He turned Intergold?s showroom in Andheri into one for Orra diamonds. Over the next few months, he?s converting most of Intergold?s 22 showrooms around the country into sparkling, new Orra stores. Says Jain, ?By giving the consumer a stand-alone shop, we are trying to promote diamonds in a big way.?

Jain isn?t the only one looking for a new route to a woman?s heart. The Sheetal Group is a spit-and-polish giant in the global diamond industry. In October, it launched the Kiah chain with a high-profile fashion show and it will have five glittering showrooms selling its branded sparklers by next month. In addition, it has tied up with top department stores and is already selling in 70 outlets.

It?s been a decade since Tanishq threw the jewellery world into a tizzy with its smart new showrooms that promised a new buying experience for affluent women. Since then, scores of other brands have made their flashy debut in the market promising modern designs combined with attractive prices. But beating the family jeweller has turned out to be a tougher game than most of the newcomers had reckoned on and many are still struggling.

|

That?s not all. Gold prices have soared to record levels over the last year and this has made it more difficult to lure customers for an impulse buy. So, many companies are switching to new offerings in platinum or diamonds. ?Diamonds are no longer viewed as a luxury or unattainable piece of jewellery. The diamond industry is on a definite upward shift,? says Sailesh Singhavi, managing director, Gitanjali Jewellers.

Tanishq, the pathbreaker in the branded jewellery business clearly agrees with that statement. In December, Tanishq, spurred on by rising gold prices and changing market conditions, launched an innovative scheme under which customers could swap gold jewellery for diamonds. As an incentive, the company promised that clients would get 10 per cent more diamonds for the price of the jewellery they were exchanging.

Or, take a look at Oyzterbay, the Bangalore-based company founded by a group of executives who broke away from Tanishq. A few months ago Oyzterbay added to the jewellery collection by tying up with with four top diamond exporters, Ace, Adora, D?damas and Sparkles. These four ? who are big in the diamond export business ? will sell their products at Oyzterbay showrooms.

Also, making its debut in the market is Hammer Plus started by European diamond retailer Hammer & Sohne. Like the others, Hammer Plus, which launched in October, is hoping to tap the growing taste for diamonds. It plans to open an exclusive showroom by April or May and it?s looking at offering Indian customers special designs created for the local market. It made its first splash in the market with the Sapta Svasti (seven auspicious) collection of seven gods and goddesses like Ganpati, Saraswati and Lakshmi. Similarly, there?s Prism, started by diamond exporter Bhansali and Co, which launched in October with Hema Malini as its chief guest. Prism plans to open its own outlets by March.

What are these newcomers offering the jewellery buyer? Branded jewellery ? whether it?s gold, diamonds, platinum or gemstones ? is obviously hoping to attract an entirely new class of jewellery buyer. The target is the urban, educated and probably working woman who has cash to spend. Says Ruchira Puri, head, marketing, Tanishq, ?Tastes in jewellery have undergone a sea change, unconventional metals and designs are coming into vogue. It?s convenient dailywear in minimalist designs that attracts today?s woman.?

There?s clearly a market for new lighter designs aren?t just worn for weddings or other high-powered family gatherings where women can flaunt their top-of-the-line glittering collections. Which is why, even giants in the jewellery trade like Nirmal Zaveri has launched its Trendsmith collection. Trendsmith, the funkier arm of Nirmal Zaveri has a mandatory 20 per cent floor space dedicated to it in every TBZ showroom, which is owned by the parent company. Over the years, others too have followed suit like Gitanjali Jewellers, which launched its Gili World Stores in Bangalore and Mumbai.

But old-style jewellers took a laidback approach to their customers. They usually waited for customers to walk into their outlets just months before a family wedding or they called a handful of favoured customers who bought on a regular basis. But the branded jewellery game is about marketing more than anything else.

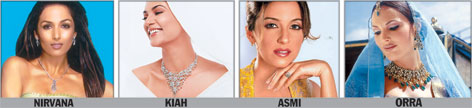

If they want to get customers, the new stores must launch high-power marketing campaigns backed by glamorous faces like Aishwarya Rai, Sushmita Sen or, in one case Gayatri Devi of Jaipur ? she has appeared in a campaign for the Diamond Trading Corporation?s (DTC) Arisia range. Other companies have also roped in celebrities for pushing their products. For instance, Perizaad Zorabian modelled for the Asmi range, Malaika Arora flaunts Nirvana jewellery and filmstars like Akshay Kumar, Suniel Shetty, Celina Jaitley and others recommend D?damas range of jewellery. Even the Big B has been roped in to endorse Solitaire. ?Several companies now scout for such associations as this increases awareness. And with so many celebrity endorsements, the sales are bound to go up,? adds Jain.

|

In addition, there are other marketing efforts like Tanishq?s Diamonds-for-Gold offer in December. ?Keeping in mind the considerable rise in gold prices and the gaining popularity of diamonds, we have introduced ?Diamonds-forGold?,? said a Tanishq executive when the scheme was launched. Adds Puri, ?The buy-back offers have helped Tanishq acquire a loyal clientele.? Tanishq today has 69 boutiques around the country and it offers more than 6,000 western and fusion-style designs in its catalogues. Its jewellery is turned out from its own factory.

The branded jewellery companies must constantly keep the marketing pot boiling. It?s also why the branded jewellery companies are constantly coming up with new collections before major festivals like Diwali or even Rakhi when they target the young buyer. They?ve even tried to tap into new-fangled Western occasions like Valentine?s Day and Woman?s Day to build a strong customer base. Says Govind Shrikhande, COO, Shopper?s Stop, where some of the top jewellery brands sell, ?Continuous and heavy advertising, is certainly creating and boosting demand for branded jewellery in India.?

The fact is that people aren?t shying away from buying lightweight everyday pieces. The ostentatious pieces are reserved for more formal occasions but for casual moments, trendy pieces that combine both contemporary and traditional designs are becoming more popular. Further, most of these brands cater to the young urban middle-class youth, who are willing to shell a few thousands for a jewel that?ll match their designer outfit. Adds Shrikhande, ?Fine jewellery purchase is seeing a movement from planned to impulse and 18K diamond jewellery is becoming more of a fashion accessory.?

Says Niharika Mehta, designer with a leading Mumbai-based jeweller, ?The pieces we design for the branded jewellery section are always a fusion of the traditional and the contemporary. They need to be casual yet trendy, distinct yet simple, modern yet traditional. We try and incorporate common motifs like the Ganapati, cross, Swastik, flowers, stars, etc. But the challenge is that we have to constantly keep ourselves updated with the changing fashion scene and international jewellery trends as the youth does have a fleeting interest.?

Other newcomers are trying even more splashy efforts to attract attention. Take a look, for instance, at Ishi?s, a one-year old brand launched by Suashish Diamonds, a DTC sight-holder. It even launched a roadshow some time ago in which it showed off a Rs 2 crore cummerbund, billed as the most expensive of its kind in the world. The company also tied up with design house Satya Paul for its brand promos.

The newcomers in the business are playing a careful pricing game. The impulse buyer has to be offered jewellery that?s cheaper than the traditional stuff bought for weddings and other such family occasions. So, a company like Orra is offering jewellery that starts from Rs 5,000 at the entry level. Its high-end stuff, however, can be anywhere upto Rs 7 lakh per piece. Other companies like Gili are also careful about pricing. Says Singhavi, ?Although expensive, diamonds are no longer viewed as a luxury or an unattainable piece of jewellery.?

The fact is that everyone is hoping to lure customers with affordable ranges. Some of the new diamond collections on offer at Oyzterbay start for as little as Rs 1,500. At the top end, the pieces sell for around Rs 25,000. Similarly, Hammer Plus is offering its Sapta Svashi collection for around Rs 13,000. The collections comes in 18K gold pendants with diamonds.

Then, there?s Tanishq which created quite a stir a few years ago when it began 18K jewellery besides the regular 24K products that Indian customers were accustomed to buying. Today, however, nobody is shocked at being offered 18K pieces and Tanishq has moved into new territory by offering diamonds and even platinum. Says Puri, ?We have constantly upgraded ourselves to suit the ever-changing tastes.?

|

What?s the size of the branded jewellery market? The fact is that nobody seems quite certain. It?s still a minuscule percentage of the Rs 40,000 crore jewellery market. Says Sanjeev Agarwal, managing director, India sub-continent, World Gold Council, ?The branded jewellery market is still nascent but is growing at an impressive pace. With aggressive TV and print ads, there?s an increased awareness among consumers about the brands.?

Branded jewellery is getting a boost in another way. As the number of malls and new-style shopping outlets grows, there are more places for these new companies to set up store in the right environment. That?s expected to give a big boost to sales in the years to come. And some companies are carefully drawing ambitious blueprints for the future. Dubai-based D?damas, for instance, hopes to have around 450-500 sales points in department stores and malls over the next two years. It plans to be selling in about 60 cities by then.

Will branded jewellery ever replace the family jeweller? The answer is obviously not for a very long time. Nevertheless, slowly but surely the Indian middle class is buying into the allure of branded glitter.

Lead photograph by Subhendu Chaki

Model: Pinky

Location courtesy: Tanishq, 1/1 Camac Street