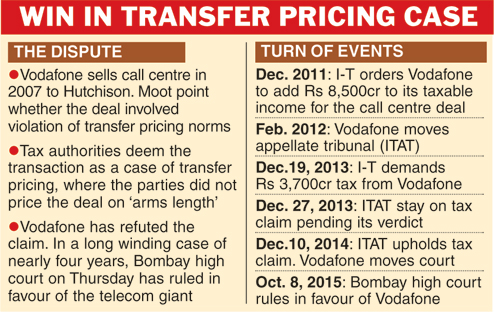

Mumbai, Oct. 8: In a major relief to Vodafone, the Bombay high court today set aside an order of the Income Tax Appellate Tribunal (ITAT) which had ruled that the tax authorities had powers to raise a tax demand on the company in a Rs 8,500-crore transfer pricing case.

Transfer pricing is a method wherein pricing is done on an arm's length basis for transactions taking place between two related entities.

The transfer pricing in this case dates back to 2008 for the sale of one of Vodafone's call centres in 2007.

Vodafone India Services (earlier known as 3Global Services) was incorporated in March 1999. It was then a part of the Hutchison Whampoa Ltd (HWL) group. It provided captive call centre services to Hutchison group companies - Hutchison 3G Australia Pty Ltd and Hutchison 3G UK. It became a part of the Vodafone International Holdings group in 2007.

However, Vodafone subsequently transferred the call centre business back to Hutchison Whampoa Properties (India) Pvt Ltd, a subsidiary of the HWL group, according to a business transfer agreement in 2007. Subsequently, the income tax authorities, in a transfer pricing order, added Rs 8,500 crore to Vodafone India Services' taxable income for the sale of the call centre business.

In February 2012, Vodafone challenged the jurisdiction of the income tax department before the tax tribunal and also approached the Bombay high court. While the tax authorities subsequently issued a tax demand on Vodafone India Services, the tribunal had stayed the demand during the pendency of the plea and directed Vodafone to deposit Rs 200 crore by February 15, 2014, which it had done.

Vodafone had argued before the tribunal that the Supreme Court order of February 2011 had upheld the company's position that there being no assignment of call options there was no question of taxable income.

It also argued that the sale of the call centre business was between two domestic companies and the transfer pricing officer had no jurisdiction over the transaction.

Vodafone India Services suffered a setback in December last year when the ITAT held that the I-T department had jurisdiction in the transfer pricing dispute.

It also said that the deal was an international transaction since the assignment of call options had taken place.

The tribunal had also held that the company had structured the deal with Hutchison Whampoa Properties with the intention to circumvent the transfer pricing norms, even though it was an international transaction wherein there was no arm's length dealing between the two related entities.

However, the tribunal referred the case back to the IT department asking it to revise the amount to be recovered from Vodafone.

Following this, Vodafone challenged the order in the Bombay high court. In a statement following today's verdict, Vodafone India said, "We welcome the decision of the Bombay high court".

The finance ministry today said it will study the Bombay high court order on the Vodafone case.

"We will study the order and then take a call accordingly," revenue secretary Hasmukh Adhia said in New Delhi.