New Delhi: The Centre has decided to merge three state-run banks - Bank of Baroda (BoB), Dena Bank and Vijaya Bank - which will create the third-largest lender in the country.

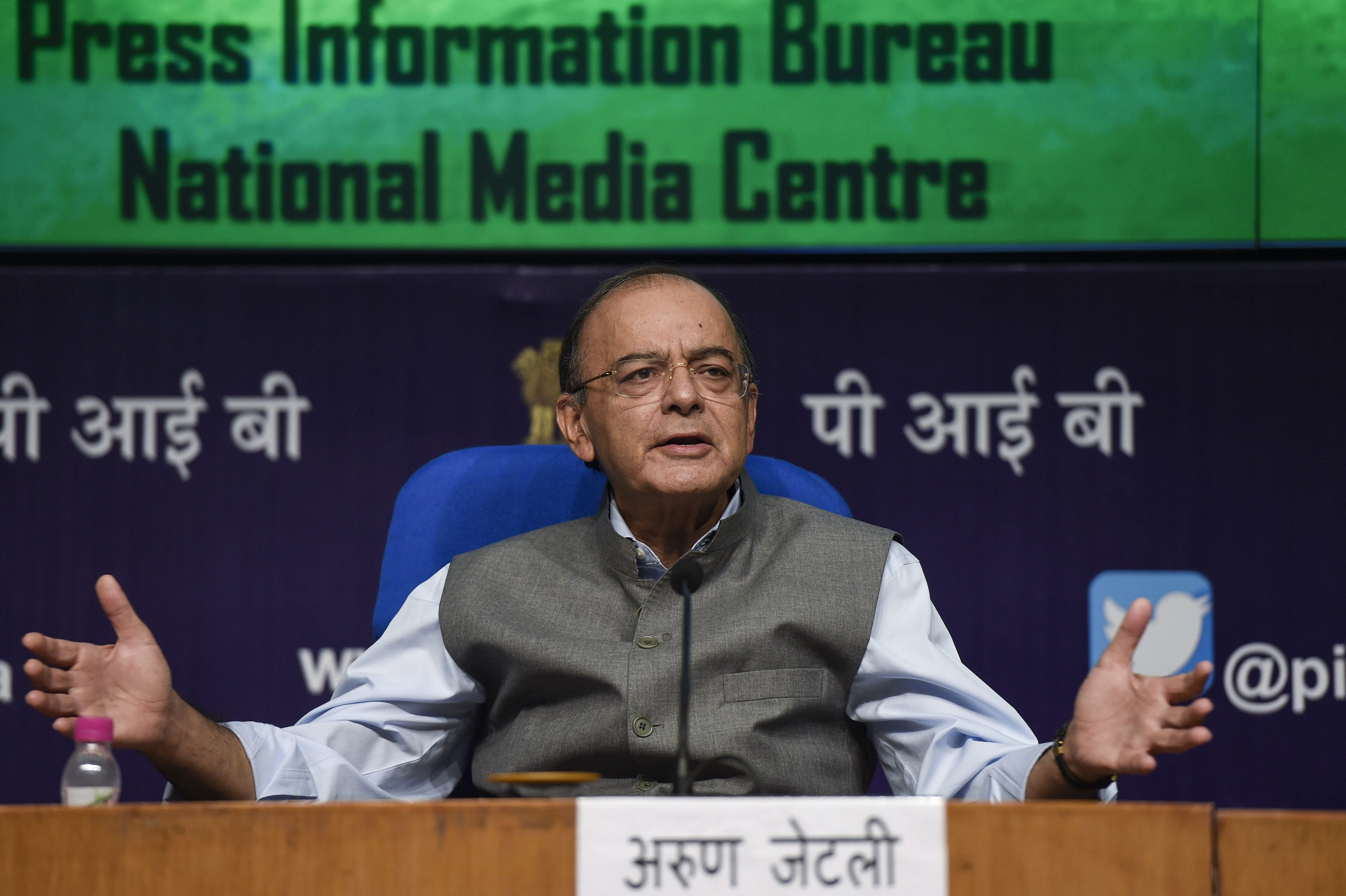

"It is a major economic, commercial decision," finance minister Arun Jaitley told reporters after the announcement was made.

The decision to merge the three banks will need to be approved by their board of directors. The banks' boards will shortly meet and take a decision, Jaitley added. The government will then prepare an amalgamation scheme for the banks, which will need to be approved by the cabinet and Parliament, Jaitley said.

The finance minister said he expected the process to be completed in the current financial year, which ends on March 31, 2019.

The new amalgamated bank will have a total business of more than Rs 14.82 lakh crore. "This will hopefully create a mega bank that will be sustainable," Jaitley added.

The merged bank will have combined deposits of Rs 8.41 lakh crore, gross advances of Rs 6.4 lakh crore, 9,489 branches and 85,675 employees.

The decision to merge the three banks came at a meeting held under the "alternative mechanism" framework that was drawn up last year to consider consolidation in banking. Besides Jaitley, the alternative mechanism includes defence minister Nirmala Sitharaman and railway minister Piyush Goyal.

Rumours had been rife in June that the loss-making Dena Bank would be merged with Baroda. The big surprise was Vijaya Bank, a reasonably profitable bank, being brought into the proposed merger.

R.A. Sankara Narayan, Vijaya Bank CEO & MD, told a TV channel he had got to hear about the merger proposal only after the news conference.

Rajeev Kumar, financial services secretary, said the merger plan was part of the effort to clean up the country's banking system.

The government will continue to provide capital support to the merged bank, Kumar added.

Kumar said there was no need to amend the Bank Nationalisation Act, and the scheme of amalgamation would be tabled in Parliament.

Banking sector reforms are a major plank of Prime Minister Narendra Modi's administration to revive credit growth, which has slowed to multi-decade lows as banks struggle with bad loans.

Jaitley said the truth of the bad loan crisis was revealed only in 2015 because the previous UPA government had been sweeping the problem under the carpet. The banking industry was saddled with bad loans - called non-performing assets in banking parlance - of Rs 8.50 lakh crore. During the UPA regime, the banks had not reported NPAs of just Rs 2.50 lakh crore, thereby concealing the seriousness of the problem.

The move to consolidate state-owned banks gathered steam after the Modi government approved the merger of five associate banks with State Bank of India in February 2017

"In the first step of consolidation, we consolidated the subsidiaries of SBI with the parent bank to create a mega global bank. LIC, which has been keen to acquire a bank for some time, has made an offer for IDBI Bank because it suited their interests.... We were waiting, before moving forward, for the situation to start turning. And therefore, now the alternative mechanism has gone ahead and taken this decision today," Jaitley said.