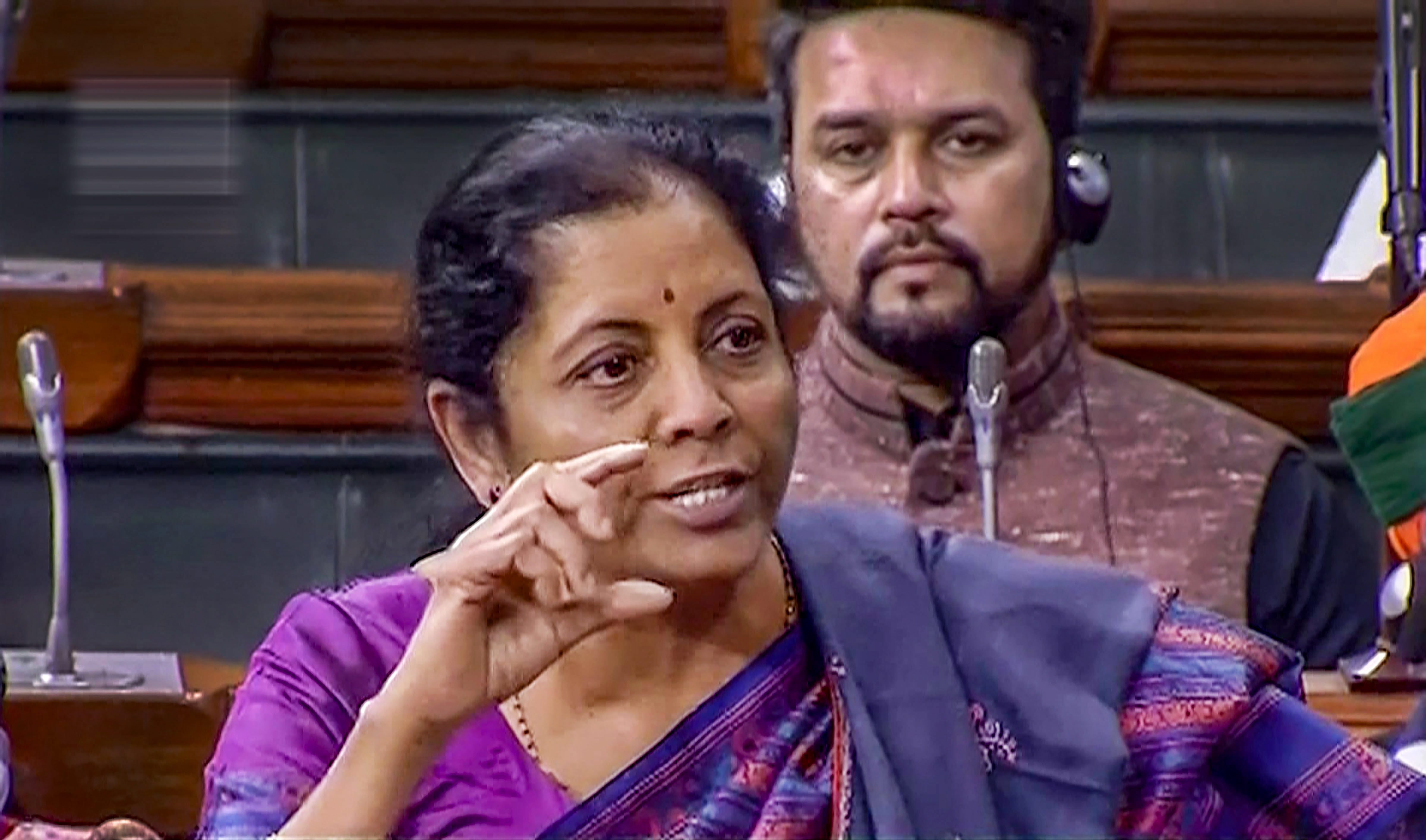

Finance minister Nirmala Sitharaman presented her first budget outlining the vision for achieving a $5 trillion economy by 2024-25, driven by investments. The push for investments will be from the infrastructure sector, in particular roads, railways, airports and inland waterways, through higher government and private investments.

For financing the infrastructure sector, Credit Guarantee Enhancement Corporation will be set-up in 2019-20. Affordable housing, too, will benefit under Pradhan Mantri Awaas Yojana (PMAY) and tax incentives.

“Make in India”, too, got a boost with the likely rationalisation of labour laws into four codes.

For MSMEs, the finance minister has raised the ceiling of 25 per cent tax rate to a revenue of Rs 400 crore (Rs 250 earlier) and introduced a platform to discount bills. This should ease the liquidity for MSMEs.

For incentivising domestic production, custom duties have been increased selectively. In line with the ambition of a cleaner and greener India, customs duties on E-vehicles have been reduced and tax deduction on interest paid on such loans has been introduced.

The minister also outlined the need to bring in a new education policy. For the real estate sector, a model tenancy law will be circulated to the states.

In order to kickstart growth, the finance minister has allocated Rs 70,000 crore to recapitalise Public Sector Banks (PSBs), which will boost credit delivery in the economy. For increasing liquidity to NBFCs, the government will provide one-time partial credit guarantee to PSBs for first loss up to 10 per cent. Given the inter-connectedness between NBFCs, HFCs and banks, HFCs will now be under the supervision of the Reserve Bank of India.

On the revenue front, the finance minister’s revenue assumptions are quite realistic. Given the difference between actual tax collections in 2018-19 and interim budget estimates, markets were worried about fiscal slippage in the year.

Tax revenues are now estimated at Rs 24.6 lakh crore in 2019-20 compared with Rs 25.5 lakh crore in the interim budget. Income tax and GST collection target for 2019-20 has been pared down, in line with GST collections in the first two months of the year. At the same time, revenue from customs and excise duties has been revised upwards on the back of higher custom duties and excise duty/ cess on petrol and diesel (Rs 2/litre).

While the Centre’s tax revenue target for 2019-20 has been reduced by Rs 55,500 crore (from the interim budget), the non-tax revenue target has been revised upwards by Rs 40,500 crore as the government now expects a higher income from dividends, railways and the 5G auction.

Disinvestments receipts are now expected at Rs 1.05 lakh crore in 2019-20 compared with an earlier target of Rs 80,000 crore since the government has decided to reduce the shareholding in non-financial undertakings to less than 51 per cent on a case-by-case basis.

On the expenditure side, the budget has more or less retained the estimates of the interim budget. The agriculture sector has got the maximum boost followed by health and education.

Sameer Narang is chief economist of Bank of Baroda