Calcutta, Sept. 1: The United Bank of India (UBI) today became the first public sector lender to declare Vijay Mallya, chairman of debt-laden Kingfisher Airlines, as a wilful defaulter.

“We have declared Vijay Mallya and three other directors of Kingfisher Airlines wilful defaulters,” UBI executive director Deepak Narang said.

The other directors declared wilful defaulters by the grievance redressal committee of the bank are Ravi Nedungadi, Anil Kumar Ganguly and Subash Gupte.

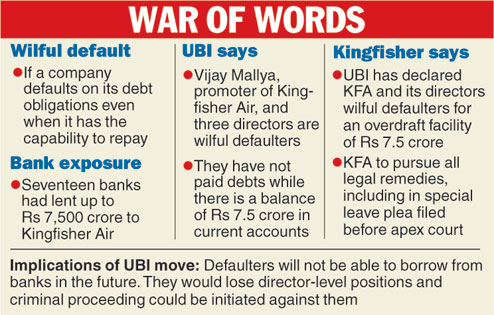

Mallya and the three directors will not be able to borrow from banks in the future. They would also lose director-level positions in companies and criminal proceeding could be initiated against them.

Commenting on the development, financial services secretary G.S. Sandhu told PTI: “Any company in which they are directors, those companies would be affected. The idea is to exclude them from the financial sector.”

Kingfisher Airlines said: “UBI has post haste proceeded to purportedly declare KFA and its directors or erstwhile directors as wilful defaulters in respect of an overdraft facility of Rs 7.5 crore. KFA intends to pursue all available legal remedies, including in the special leave petition filed before the Supreme Court.”

Narang said the decision of the redressal committee would be conveyed to the finance ministry, the Reserve Bank of India and Sebi.

The committee meeting was convened today after a Calcutta High Court division bench allowed the bank to initiate the process of declaring them as wilful defaulters last week. It had asked the directors to be present before it but no one turned up.

|

The UBI had first given notice to declare Kingfisher Airlines as a wilful defaulter on May 28. However, the company approached Calcutta High Court against the notice.

The single bench dismissed the company’s plea. Subsequently, the company approached a double bench, which upheld the single bench’s order on August 28. Following this, the bank gave a 72-hour notice to the company and its directors, which ended today.

When asked about the implication of such a move, UBI sources said that unless the defaulters were removed from the board, the company would no longer be eligible for funds. The Calcutta based bank’s decision today could also impact future debt funding of other group companies where Mallya is a board member.

The UBI is among the consortium of 17 banks that has lent to Kingfisher Airlines. The total exposure of the banks had run up to Rs 7,500 crore.

The State Bank of India, Punjab National Bank, IDBI Bank, Bank of India, Bank of Baroda, Central Bank of India and Uco Bank are among the major lenders of Kingfisher Air.

The SBI alone had an exposure of around Rs 1,600 crore, while IDBI and PNB have an exposure of around Rs 800 crore. The exposure of UBI was Rs 400 crore. The bankers initiated a recovery process last year, which includes the sale of properties in Mumbai and Goa.

The lenders have already filed a winding up petition of the airlines in Karnataka high court in December last year.

Mangalore Chem hurdle

Today’s decision may also raise concerns about the future of a joint open offer of United Breweries Group and Adventz to acquire a controlling interest in Karnataka-based Mangalore Chemicals and Fertilizers Ltd (MCFL).

Adventz Group chairman Saroj Poddar had in May teamed up with Mallya to up the bid price for a 26 per cent stake in MCFL to thwart a move by Deepak Fertilisers and Chemicals, which has been trying to acquire a controlling stake in the company. Mallya was supposed to continue as the chairman of MCFL.