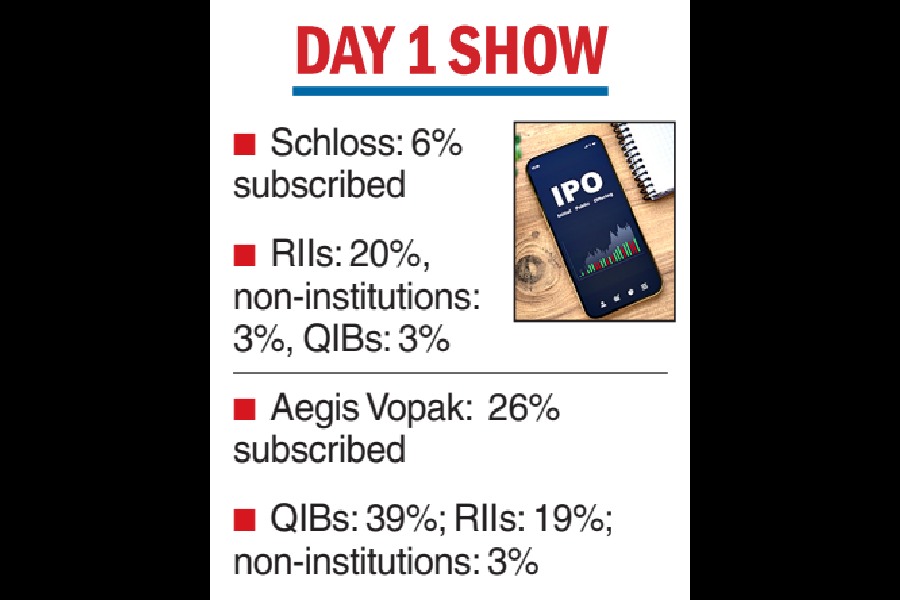

The initial public offering of Schloss Bangalore, which operates Leela Palaces Hotels and Resorts, was subscribed only 6 per cent on the first day of bidding, while that of Aegis Vopak Terminals, a subsidiary of Aegis Logistics, received a 26 per cent subscription.

For Schloss Bangalore, the initial share sale received bids for 28,75,176 shares against 4,66,10,169 shares on offer, according to NSE data.

The category for retail individual investors (RIIs) received 20 per cent subscription, while the quota for non-institutional investors was subscribed 3 per cent. The portion for qualified institutional buyers (QIBs) received a 3 per cent subscription too.

Schloss Bangalore Ltd has garnered ₹1,575 crore from anchor investors. The issue, with a price band of ₹413-435 per share, will conclude on May 28.

For Aegis Vopak Terminals, the initial share sale received bids for 1,77,71,355 shares against 6,90,58,296 shares on offer, according to NSE data.

The portion for Qualified Institutional Buyers (QIBs) fetched 39 per cent subscription, while the category for Retail Individual Investors (RIIs) got subscribed 19 per cent.

Non-institutional investors part received a 3 per cent subscription.

Aegis Vopak Terminals has raised ₹1,260 crore from anchor investors.

The issue, with a price band of ₹223 to ₹235 per share, will conclude on May 28.

The company is valued at around ₹26,000 crore at the upper end of the price band.