The telecom regulator has drastically slashed the reserve prices for the radio waves that the Modi government intends to auction later this year.

In a 433-page document released on Monday, the Telecom Regulatory Authority of India set the reserve prices for 10 spectrum bands in the country’s 22 telecom circles.

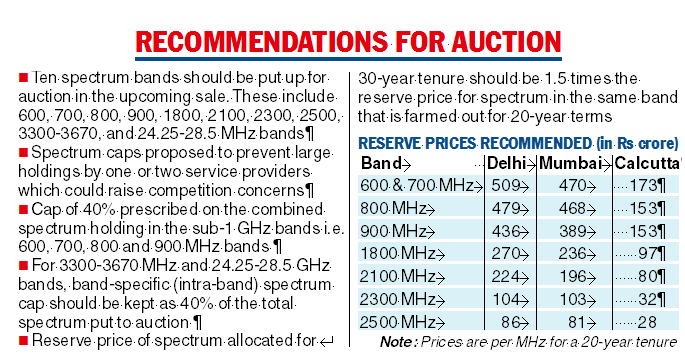

The reserve prices were set for seven spectrum bands that the mobile telephony currently use: 700 MHz, 800 MHz, 900 MHz, 1800 MHz, 2100 MHz, 2300 MHz and 2500 MHz.

The reserve prices have also been fixed for three new bands — 600 MHz, 3300-3670 MHz and 24.25-28.5 GHz, which is the so-called millimeter band that offers the advantage of blazing data transmission speeds with the downside that data can travel only short distances with a high risk of signal attenuation.

The regulator decided against auctioning airwaves in the 526-612 MHz range as this band is still being used by the ministry of information and broadcasting (MIB).

“Since MIB is using the 526-582 MHz band extensively across the country for analogue TV transmitters, the 526-612 MHz frequency range should not be put to auction in the forthcoming sale,” Trai said in a statement.

The regulator suggested a 40 per cent reduction in the reserve price for the 700 MHz band and pared the price for the 3300-3670 MHz band (the so-called 5G spectrum band) by 36 per cent.

It has recommended a 35.6 per cent cut in base price for the 3300-3600 MHz band to Rs 317 crore on a pan-India basis compared with Rs 492 crore recommended in 2018.

For the 700 MHz, on a pan-India basis, the base price comes to Rs 3,927 crore per MHz, which is 40 per cent lower than the prices recommended by the regulator in 2018.

Metro circle prices cut

The sharpest cut in the reserve price for a metro circle was in the 2100 MHz band in Delhi where it was set at Rs 224 crore per MHz — down 64.7 per cent from Rs 635 crore set in August 2018.

The biggest cut in Mumbai was also in the 2100 MHz band at 62.9 per cent with the reserve price cut from Rs 528 crore in 2018 to Rs 196 crore.

In Calcutta, the sharpest fall was in the 700 MHz band where the reserve price was cut by 50.1 per cent to Rs 173 crore from Rs 347 crore earlier.

In its recommendations, the telecom regulator set the highest reserve price for the 600 and 700 MHz bands at Rs 509 crore per MHz in Delhi, Rs 470 crore in Mumbai and Rs 173 crore in Calcutta.

The upcoming 5G auction is an opportunity for the government to raise big bucks — as it did in the famous auction of 2010 — but it must guard against being too greedy by setting high reserve prices that deter bidders and leave a lot of radio waves unsold.

That is a situation that occurred in March 2021 when 855.60 MHz of the 2250 MHz on offer — or just 38 per cent —was sold for a little over Rs 77,800 crore. Reliance Jio acquired 697 MHz of the spectrum on offer in all the bands for Rs 57,100 crore — while the debt and dues-laden legacy players like Airtel and Vodafone opted to nibble at only small parcels.

The regulator suggested a 50 per cent discount to the reserve prices for NorthEast and Jammu and Kashmir circles in the 800, 900, 1800, 2100, 2300, and 2500 MHz bands.

Spectrum cap

The regulator wants to stop any telecom service provider from cornering spectrum and, therefore, suggested spectrum caps to prevent large holdings of the air waves which could stoke competition concerns.

It suggested a cap of 40 per cent on the combined spectrum holding in the sub-1 GHz bands i.e. 600 Mhz, 700 Mhz, 800 Mhz and 900 Mhz bands.

For 3300-3670 Mhz and 24.25-28.5 GHz bands, it said a band-specific spectrum cap should be kept as 40 per cent of the total spectrum put to auction.

The 5G price is still high. Companies that acquire the spectrum will be hard-pressed to expand the service beyond select large cities, telecom analyst Mahesh Uppal said.