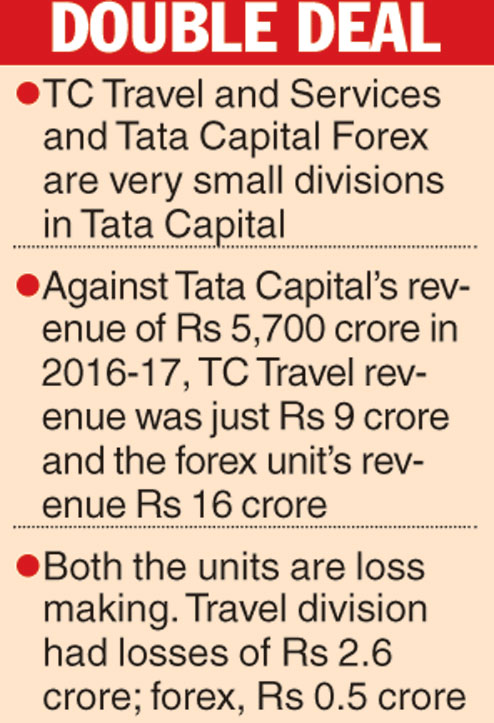

Mumbai, Sept. 25: Tata Capital is selling its foreign exchange and travel services units to Thomas Cook India for an undisclosed sum.

"Our acquisition of Tata Capital's forex and travel companies serves to further strengthen Thomas Cook India Group's leadership position in the travel and foreign exchange sector in the country," Thomas Cook (India) chairman & MD Madhavan Menon said.

He added that the acquisition also gives the company the opportunity to continue to serve the strong portfolio of both Tata Capital Forex and TC Travel Services Ltd - large corporate houses, including flagship Tata Group companies as also a set of new retail customers.

According to Menon, the acquisition will create opportunities to improve customer service and stakeholder value.

"Travel and forex services are perfectly poised for rapid and high growth. We are confident that Thomas Cook will take this business forward and help it reach its potential," Tata Capital MD and CEO Praveen Kadle said.

The acquisition failed to make any impact on the Thomas Cook India scrip, which ended marginally lower at Rs 231.15 on the BSE.

Tata Capital, which was set up in 2007, has over 100 branches and it is a subsidiary of Tata Sons. It is registered with the Reserve Bank of India (RBI) as a systemically important non-deposit accepting core investment company. '

For the year-ended March 31, 2017, Tata Capital reported a strong asset quality with both gross and net non-performing assets showing a decline compared with the previous year.

According to its annual report for 2016-17, Tata Capital's book size increased from Rs 43,881 crore as on March 31, 2016 to Rs 51,847 crore as on March 31, 2017 on a consolidated basis. This increase of about Rs 7,966 crore was largely due to the growth in the loan book of two major subsidiaries - Tata Capital Financial Services and Tata Capital Housing Finance.