New Delhi, Feb. 23: Bharti Airtel, India's top telecom network operator, is buying Norwegian Telenor's India unit, in yet another consolidation move in the country's telecom sector driven by rival Jio's disruptive pricing.

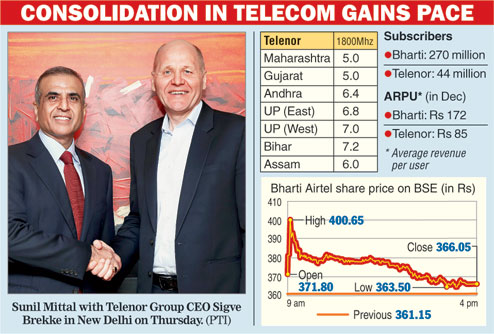

Bharti Airtel said on Thursday it will buy Telenor (India) Communications as part of which it will acquire the Norwegian company's operations in seven circles in six Indian states.

A Telenor spokesman said Bharti will not pay any cash under the deal but will instead take on the Telenor unit's commitments to pay for licences and phone towers.

The acquisition, which also includes Telenor's India employees and its 44 million customers, will not lead to any impairment charges for Telenor.

The deal highlights how the entry of Jio - Reliance Industries' wireless carrier - late last year is shaking up India's crowded telecom sector. With its free voice and deeply discounted data plans, Jio has pushed rivals to slash rates, sharply eroding their profits.

Expectations have grown for continued consolidation, likely culminating in the emergence of a few large players and the exit of smaller players like Telenor, which accumulated losses of 24 billion NOK ($2.87 billion) since entering India in 2008, and has assets in the country of just 0.3 billion NOK.

Britain's Vodafone Group is already in talks to merge its Indian subsidiary with Idea Cellular, potentially overtaking Bharti Airtel as India's largest mobile operator with about $12 billion in sales.

Deal logic

Telenor said it was going in for the deal as it believed that it could not find the money needed to sustain and grow the business.

"Finding a long-term solution to our India business has been a priority for us ... After thorough consideration, it is our view that significant investments needed to secure Telenor India's future business on a standalone basis would not have given an acceptable level of return," said Sigve Brekke, chief executive officer of Telenor Group.

The buy-out will be subject to regulatory approvals, including approvals from the department of telecommunications (DoT) and the Competition Commission of India.

Telenor India operates in seven circles - Andhra Pradesh, Bihar, Maharashtra, Gujarat, UP (East), UP (West) and Assam. These circles represent a high population concentration and, therefore, offer a potential for growth, the company said.

"The proposed acquisition will undergo seamless integration, both on the customer as well as the network side, and strengthen our market position considerably in several key circles," said Gopal Vittal, managing director and CEO (India and South Asia) of Bharti Airtel.

Airtel, in which Singapore Telecommunications is the second-biggest shareholder, is India's largest wireless operator with over 269 million subscribers and a revenue market share of over 33 per cent.

As of the fourth quarter of 2016, the remaining value of tangible and intangible assets in Telenor India amounted to Norwegian Kroner 300 million or $36 million.

The transaction is expected to close within 12 months. With effect from the first quarter of 2017, Telenor India, which entered the Indian market in 2008, will be treated as an asset held for sale and discontinued operations in Telenor Group's financial reporting.

Jio effect

Rating agency Fitch in a note said the agreement is the "latest sign that the entry of Reliance Jio is spurring incumbents to consolidate" which will see "intense competition and weaker telcos exiting altogether".

The on-going consolidation is likely to leave four larger operators - Bharti Airtel-Telenor, Mukesh Ambani-owned Jio, Vodafone India-merged with Idea Cellular, and a similar merger between Anil Ambani's Reliance Communications and Aircel Limited.

Benefits for Airtel

Acquisition of Telenor's business will increase Airtel's revenue market share by two percentage points to 35 per cent and will add up to $60 million to its pre-tax profits, Fitch added.

There will not be any rating impact on Bharti as a result of it. However, benefits from additional spectrum assets will offset the spectrum liabilities taken over.

Shares of Bharti Airtel rose 11 per cent to an intra-day high of Rs 400.65 against Wednesday's close - the highest in one-and-a-half years - after the deal was announced. The share closed at Rs 366.05, up Rs 4.90, or 1.36 per cent, from Wednesday's close of Rs 361.15 on the BSE.