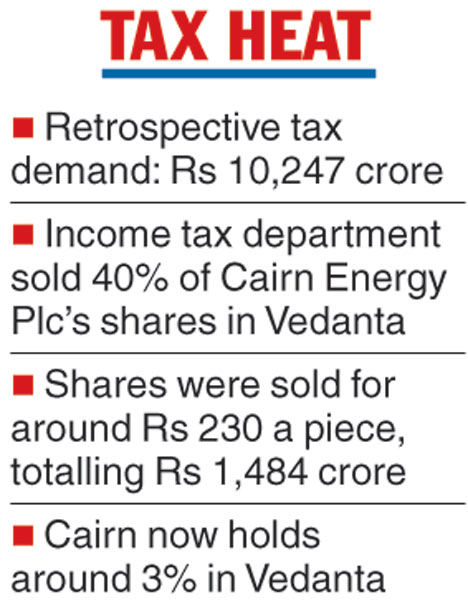

New Delhi: The income-tax department has sold about 40 per cent of British oil firm Cairn Energy Plc's shares in Vedanta to recover part of the Rs 10,247-crore demanded as a retrospective tax.

The move by the tax department comes weeks before an international arbitration tribunal is set to begin its final hearing, challenging the retrospective tax demand.

Cairn Energy said the tax department sold about 2 per cent of the firm's shares in Vedanta in at least five tranches totalling $216 million, and may sell the remaining stake as well.

The Central Board of Direct Taxes (CBDT) had stated that "there is no legal advice against the sale of the attached shares".

The tax department had come close to selling the shares in March but aborted the move at the last moment.

In January 2014, the tax department had used a two-year-old retrospective tax law to raise Rs 10,247 crore on alleged capital gains made by Cairn Energy on a decade-old internal reorganisation of its India business.

This was followed by attaching the company's residual 9.8 per cent shares in its erstwhile subsidiary Cairn India. Cairn India was subsequently merged with its new parent Vedanta, in which Cairn Energy held about a 4.95 per cent stake.

These shares continued to be attached for four years but the tax department had earlier this year got them transferred to it.

Cairn said the tax department had continued to enforce its retrospective tax claim against the company, while the arbitration initiated under the UK-India Bilateral Investment Treaty has been ongoing.

"To date, the tax department has seized dividends due to Cairn from its shareholding in Vedanta totalling $155 million and it has offset a tax rebate of $234 million due to Cairn as a result of overpayment of capital gains tax on a separate matter," it said.

The shares were sold for around Rs 230 a piece. Following this sale, Cairn's retained holding in Vedanta is now approximately 3 per cent. "It is possible that the income tax department may make further sales," it said.

Arbitration process

Cairn Energy has challenged the retrospective tax demand through an international arbitration, the final outcome of which is expected later this year.

"All of the written submissions by Cairn and the Government of India have now been made, and the final arbitration hearings are scheduled for two weeks commencing on August 20, 2018 in The Hague. These hearings will involve testimony by expert and witnesses and will address Cairn's claims under the treaty, India's defences and issues of jurisdiction," it said.

Cairn said it is, through the arbitration, seeking reparation of the monetary value required to restore the firm to the position it would have enjoyed in 2014 but for the Government of India's actions are in breach of the treaty.