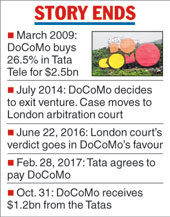

New Delhi: NTT DoCoMo has received $1.2 billion or 144.9 billion yen from Tata Sons, bringing the curtain down on a two-year old dispute over their telecom joint venture.

The Japanese giant, in a posting on its website on Tuesday, said it "has received from Tata Sons payment of the award amount in accordance with the High Court of Delhi's decision regarding DoCoMo's stake in Tata Teleservices Limited".

The amount of 144.9 billion yen received by DoCoMo pertains to the arbitration award and includes interest earned and other costs awarded.

"Concurrent with the receipt of the above amount, all shares in TTSL held by DoCoMo have been transferred to Tata Sons and companies designated by Tata Sons," the posting on the website said.

In mid-September, there were reports that the Indian tax authorities had slapped NTT DoCoMo with a tax demand of Rs 2,500 crore after it won the arbitration award against the Tatas.

The Japanese telecom giant was the first multinational to face a tax demand on an arbitration payout.

It is not known whether NTT Docomo made such a payout to the tax authorities.

In its press release today, the Japanese company said: "DoCoMo expects to include the award amount of 144.9 billion yen in other income on its consolidated financial statements for the three-month period ending December 31, 2017."

"DoCoMo expects to include a loss on transfer of investments in affiliates of 29.8 billion yen, equal to the reclassification adjustments of foreign currency translation adjustments, in other expense on its consolidated financial statements for the three-month period ending December 21, 2017."

The amount of 29.8 billion yen is equal to Rs 1,700 crore - which is 20 per cent of the arbitration award.

The Japanese company said net income would "be adjusted to 740 billion yen and free cash flow will be adjusted to 855 billion yen in DoCoMo's forecasts of consolidated financial results for the fiscal year ending March 31, 2018".

In February, Tata Sons had said it had reached an agreement with the NTT DoCoMo "on a joint approach to enable enforcement" of a compensation award granted by the London Court of International Arbitration (LCIA) in 2016 in favour of the Japanese company.

However, the $1.17-billion Tata-DoCoMo settlement was challenged in March this year by the Reserve Bank of India (RBI) at a hearing before the Delhi high court.

The RBI, which had become a party to the dispute last year, argued that a fixed rate of return on exiting a company was illegal.

As the RBI is the custodian of India's foreign exchange, and expatriation of large sums under certain circumstances requires its permission, the intervention becomes important for a settlement of the dispute between Tatas and Japanese telecom giant NTT DoCoMo.

The RBI based its objections on norms set out by the central bank three years back which specified that foreign companies can only exit investments at a valuation based on the return on equity.

In November 2009, DoCoMo had acquired a 26.5 per cent stake in Tata Teleservices for about Rs 12,740 crore at Rs 117 per share. This acquisition had a clause that if NTT DoCoMo exits the venture within five years, it will be paid a minimum 50 per cent of the acquisition price.

In 2014, Tatas had sought to buy back NTT's shares at the acquisition price of Rs 58.05 per share. At that time the fair market value was determined to be Rs 23.34 per share. The RBI, however, did not allow the sale as rules at that time did not allow sale of shares in an unlisted Indian company at pre-determined prices.

The Japanese company dragged the Tatas to international arbitration where it had won the $1.18-billion award. It also filed a plea in the Delhi high court seeking enforcement of the arbitration ruling.