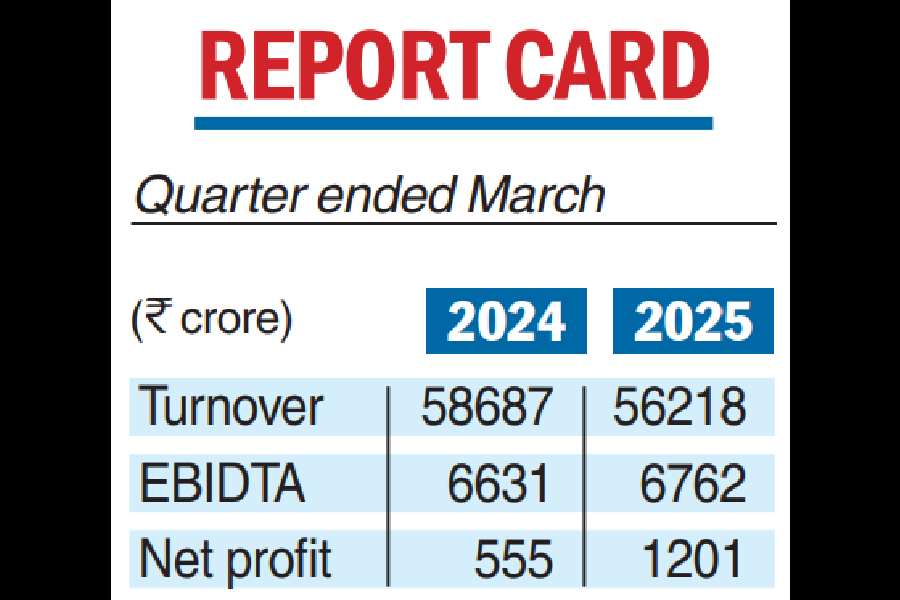

Tata Steel posted a 116 per cent rise in profit after tax at ₹1,201 crore in the quarter ended March 31 against ₹555 crore in Q4FY24 on a consolidated basis on the back of a lower raw material expense, cost optimisation and improved performance in the Netherlands.

Turnover of the company, however, slipped 4.2 per cent to ₹56,218 crore in Q4FY25 from ₹58,687 crore in the same period of FY2024.

For the full year, Tata Steel swung to a profit of ₹3,174 crore against a loss of ₹4,910 crore in FY24. Turnover, however, came off by 4.6 per cent to ₹218,543 crore in FY25 to ₹229,171 crore, reflecting lower steel prices.

FY25 EBITDA stood at ₹25,802 crore with a margin of around 12 per cent, improving by 10 per cent YoY despite the challenging operating environment.

Deliveries in Q4 stood at 8.83 million tonnes, up from 7.98 mt in Q4FY24 as Tata Steel progressively ramped up the new 5 mt capacity at Kalinganagar, Odisha. For the full year, deliveries stood at 30.96 mt compared with 29.39 mt in FY24.

The board of the company announced a dividend of ₹3.6 per share (360 per cent).

Tata Steel’s markedly profitable India operation reported a PAT of ₹3,141 crore in Q4 and ₹13,803 crore in FY25, compared with ₹3,897 crore in Q4FY24 and ₹14,702 crore in FY24.

The company has spent ₹3,220 crore on capital expenditure during the quarter and ₹15,671 crore for the full year. Gross debt stood at ₹94,801 crore, down from ₹98,919 crore in FY24.

Tata Steel’s results were hobbled by the UK operations despite closing the blast furnace.

EBIDTA loss more than doubled to ₹873 crore in Q4, compared with ₹388 crore during same period of last year.

However, the Netherlands business returned to black at the operational level with a positive EBIDTA of ₹124 crore in Q4FY25 compared with ₹296 crore loss in Q4FY24.

Commenting on the performance, T.V. Narendran, managing director & CEO of Tata Steel described FY25 as an ‘important transition year’.

“We commissioned India’s largest blast furnace at Kalinganagar, safely decommissioned two blast furnaces in the UK and achieved production levels near rated capacity in the Netherlands,” Narendran said.

He pointed out that surging imports in the UK negated the benefit of fixed costs reduction of £230 million.

Koushik Chatterjee, executive director and CFO of the company, informed that Neelachal Ispat Nigam Limited, which was acquired three years ago in closed condition, had turned around with an annual EBITDA of around ₹1,000 crore with a margin of 19 per cent and a free cash flow in excess of ₹1,000 crore.