|

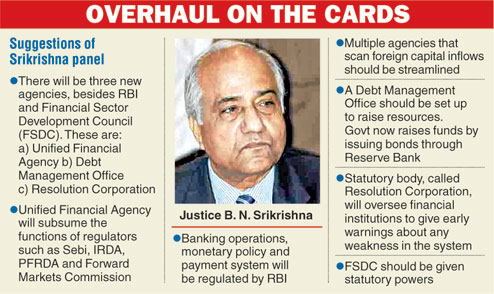

New Delhi, March 22: A government-appointed panel has suggested a super regulator that will lord over the watchdogs for capital market, commodity, insurance and pension, but left the banking business under the RBI’s independent supervision.

The proposal for a super regulator for financial services has been hugely contentious with the RBI — the country’s oldest regulator having been established in 1935 — baulking at the idea of losing its independence and having to kowtow to a super boss.

The committee appears to have suggested a way out of the impasse by leaving the RBI out of the ambit of the Unified Financial Agency, which will subsume the functions of key agencies such as Sebi, IRDA, PFRDA and the Forward Markets Commission.

Banking operations, monetary policy and payment system will continue to be regulated by the RBI.

The Financial Sector Legislative Reforms Commission, headed by Justice B.N. Srikrishna, has also suggested in its final report the need to scrap the multiple agency architecture for scanning foreign capital inflows.

At present, while the FDI policy is framed by the department of industrial policy and promotion, the proposals are cleared by the Foreign Investment Promotion Board after getting clearances from various agencies such as the Enforcement Directorate, the CBI and the RBI.

The report, which was submitted to finance minister P. Chidambaram, also suggested setting up a Debt Management Office to raise resources for government expenses. At present, the government raises funds by issuing bonds through the Reserve Bank.

The report, Chidambaram said, will be made public in 3-4 days. “I intend to brief the Prime Minister either today or tomorrow and in the next 3-4 days (it will be) in public domain,” he said.

Once the recommendations are adopted, the government will have to bring in legislative changes in 20-25 existing acts to facilitate the new structure.

Srikrishna said the final report is on the lines of the approach paper that the panel had come out with in October last year. “Most of them are in line with the approach paper. But there are certain issues on which we have now more inputs. So, they have been modified,” he said.

Officials said the final report had suggested a sunset clause of 10 years for financial sector laws. Though the proposal was not part of the approach paper, the commission had earlier indicated that some of the legislations were obsolete and irrelevant in the current environment. A sunset clause would mean the government would have to review the law after its expiry.

The final report has recommended that most of the laws (except those relating to the government such as PPF and savings) should be repealed, officials said.

According to Srikrishna, there was no conflict between the two proposed regulators. He also clarified that there would not be a super regulator architecture.

Debt office debate

The Debt Management Office was housed in the finance ministry a couple of years ago but the move to create an independent agency to handle debt issues with no say by the RBI has drawn the central bank’s criticism in the past.

In a speech delivered at Basel in May 2011, RBI governor D. Subbarao had expressed his deep reservations about forming an independent debt agency.

One of the arguments made by the proponents of the move is that nowhere in the developed world does the monetary authority deal with debt management.

The other argument is over the conflict of interest. It is argued that the central bank will be biased towards a low-interest regime to reduce the costs of sovereign debt even if it compromises its anti-inflation stance. A similar conflict may also distort the open market operations of the central bank.

Subbarao said the arguments, though valid in some countries, “fail to recognise that in countries such as India, given the large size of the government borrowing programme, sovereign debt management is much more than merely an exercise in resource raising”.

But it is obvious that Subbarao’s arguments have neither weighed with the government nor the Srikrishna panel.