Japan’s second-largest banking group, Sumitomo Mitsui Financial Group (SMFG), through its wholly owned subsidiary Sumitomo Mitsui Banking Corporation (SMBC), will acquire a 20 per cent stake in Yes Bank for ₹13,483 crore.

This move will make SMBC the largest shareholder in Yes Bank and marks a major foreign investment in India’s banking sector.

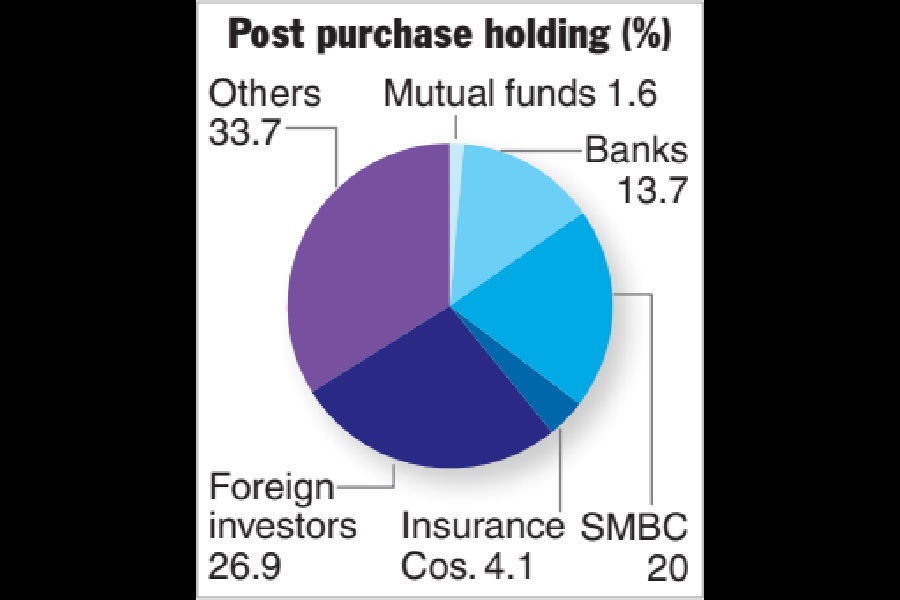

State Bank of India (SBI) and seven other lenders, which had collectively invested in Yes Bank as part of the bank’s reconstruction scheme in March 2020, will divest their stake. SBI, which currently holds a 23.97 per cent stake, will dilute 13.19 per cent for ₹8,889 crore. The remaining 6.81 per cent will be offloaded by Axis Bank, Bandhan Bank, Federal Bank, HDFC Bank, ICICI Bank, IDFC First Bank, and Kotak Mahindra Bank for ₹4,594 crore.

The sale is priced at ₹21.50 per share. Post-transaction, SBI’s stake will reduce to just over 10 per cent. As of March 31, 2025, the shareholding of the other seven banks in Yes Bank was: HDFC Bank (2.75 per cent), ICICI Bank (2.39 per cent), Kotak Mahindra Bank (1.21 per cent), Axis Bank (1.01 per cent), IDFC First Bank (0.92 per cent), Federal Bank (0.76 per cent) and Bandhan Bank (0.70 per cent).

The deal is subject to regulatory and statutory approvals, including from the Reserve Bank of India and the Competition Commission of India. Yes Bank said that the transaction is a significant milestone to drive its next phase of growth, profitability and value creation, and we expect to leverage SMBC’s global expertise in this phase.

SMBC, a scheduled foreign bank in India, is a subsidiary of SMFG, which manages assets of $2 trillion as of December 2024 and has a significant global presence. SMFG also operates SMFG India Credit Company Limited, a diversified NBFC in India.

Yes Bank MD and CEO Prashant Kumar said SMBC’s investment marks a pivotal step in the bank’s growth, bringing global expertise and high governance standards.

“Over the past few years, our growth has been shaped by the strong partnership and unwavering support of SBI, and they will continue to remain a valued stakeholder,” he said.

SMFG president and group CEO Toru Nakashima and SMBC CEO Akihiro Fukutome emphasised India’s dynamic economy and long-term growth potential as key factors driving their investment.