SoftBank on Friday offloaded a little over 5 per cent of the equity of PB Fintech, the Policybazaar parent, in a block deal worth Rs 1,043 crore on the NSE.

Data available from the stock exchange showed that SVF India Holdings (Cayman)Ltd, a SoftBank arm, sold 2.2 crore shares at Rs 456.40 apiece. These shares constituted around 5.08 per cent of PBFintech’s equity.

The shares were picked up by mutual funds and foreign portfolio investors (FPIs).

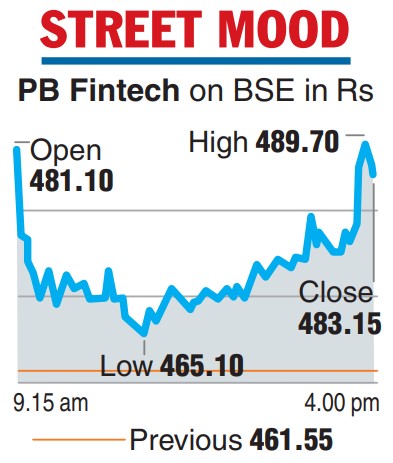

Shares of PB Fintechended higher on the transaction and closed at Rs 483.15 —a gain of 4.68 per cent on the BSE. At the NSE, it settled at Rs 485 — a rise of 5.21 per cent over the previous finish.

During the quarter ended September 30, 2022, SoftBank held around 10.16 per cent in PB Fintech through SVF IndiaHoldings (Cayman) Ltd and SVF Python II (Cayman) Ltd. It has thus halved its stake through Friday’s deal.

In recent weeks, institutional investors have sold shares in new-age firms such as One97 Communications, the parent of Paytm, and Nykaa parent FSN E-commerce Ventures that got listed last year. It resulted in these counters coming under pressure and affecting their valuations further.

While PB Fintech was listed in November last year, it has been trading below the issue price of Rs 980 per share. At the current market price, the PB Fintech share is trading at a discount of nearly 51per cent to the issue price.

Last month, Tiger GlobalManagement had offloaded shares of PB Fintech for Rs522 crore through open market transactions.

Funds managed by TigerGlobal — Tiger Global Eight Holdings and Internet FundIII Pte — sold 1,34,17,607 shares, amounting to 2.98 per cent stake in the company