Mumbai, July 28: The Securities and Exchange Board of India (Sebi) today cancelled the registration of Sahara Mutual Fund saying it was no longer "fit and proper" to carry out the business.

The regulator has now ordered the transfer of Sahara's operations to a new sponsor and an asset management company at the earliest.

The cancellation of the certificate of registration will be effective after six months from the date of the Sebi order.

Till such time, Sahara Asset Management Company (Sahara AMC) has been directed to not take any new subscription from investors, which includes existing investments in Systematic Investment Plans (SIP) or Systematic Transfer Plans (STP).

Moreover, Sahara Mutual Fund cannot levy any penalties or loads on these investors for not depositing their instalments, a 22-page order by Prashant Saran, whole-time member of Sebi, said today.

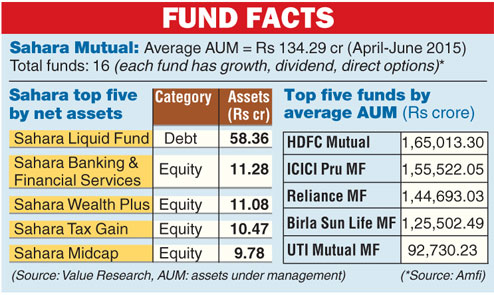

According to Association of Mutual Funds of India (Amfi) data, Sahara Mutual Fund's average assets under management (AUM) stood at Rs 134.29 crore as of June. The fund house has 10 equity-oriented schemes and six debt schemes.

Market observers said the order meant there would be no bar on existing investors of Sahara Mutual Fund to sell their units.

The Sebi order further said if Sahara Mutual Fund failed to complete the process of transition within five months from the date of the order, it would have to compulsorily redeem the units allotted to its investors and credit the respective funds to its investors, without any additional cost, within a period of 30 days thereafter and wind up the operations of the mutual fund.

Sahara Mutual Fund's board of trustees has been asked to "oversee and ensure protection of the unit-holders' interests'' during this period. The board will have to be re-constituted after the transfer, Sebi added.

It may be recalled that in February, the regulator had cancelled the portfolio management licence of Sahara AMC.

The Sahara group has been engaged in a long-running legal battle with Sebi since the regulator ordered a refund of over Rs 24,000 crore by two Sahara entities in 2011.

This order had then restrained promoter Subrata Roy from associating with any listed public company and any public company which intends to raise money from the public till the said payments were made to the satisfaction of Sebi.

According to Sebi, Regulation 7(aa) read with Regulation 10 of the Mutual Fund Regulations requires that the applicant for the mutual fund should be a fit and proper person.

"In terms of Regulation 21(aa) read with Regulation 22 of the MF Regulations, the AMC is required to be a fit and proper person to carry out the functions for the mutual fund... Thus, considering the Sebi order dated June 23, 2011, the pending contempt proceedings against Subrata Roy, SHICL/ SIRECL (group companies of Sahara) and other litigations initiated and pending against Subrata Roy, Sahara MF along with the Sahara AMC and Sahara Sponsor are no longer fit and proper persons to carry out the business of a mutual fund," the order said.

Sebi added that the AMC has failed to file details about Subrata Roy in the prescribed bio-data format as directed by Sebi in its June 2011 order.

It added that Subrata Roy had failed to provide the required information under the MF Regulations since June 23, 2011.

According to Sebi norms, an AMC has to file a detailed bio-data of all its directors along with their interest in other companies within 15 days of their appointment.