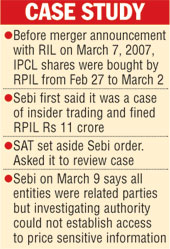

Mumbai, March 9: Capital market regulator Sebi has let off Reliance Petroinvestments Ltd (RPIL), a Mukesh Ambani group company, in an almost nine-year-old alleged insider trading case involving the shares of erstwhile Indian Petrochemicals Corporation Ltd (IPCL) because of lack of evidence to establish prior access to sensitive information.

Sebi's move comes nearly three years after it imposed a penalty of Rs 11 crore on the company for violating insider trading norms while trading in the shares of IPCL.

The penalty was levied after Sebi found out that RPIL had unpublished price-sensitive data that included the announcement of interim dividend and amalgamation before trading in the IPCL scrip.

According to Sebi, RPIL, in 2007, had bought 21,32,953 shares of IPCL for around Rs 55.51 crore at an average price of Rs 259.42 per share between February 27 and March 2. The transaction took place prior to the declaration of interim dividend (March 2, 2007) and the announcement of the amalgamation of IPCL (on March 7, 2007) with RIL. The price-sensitive information was still unpublished when the shares were purchased.

It was also alleged that RPIL did not sell any share of RIL till March 31, 2007 and received a dividend of Rs 6 apiece amounting to over Rs 1.27 crore. Sebi was of the view that it resulted in a violation of Regulation 3 of Sebi (Prohibition of Insider Trading) Regulations, 1992.

However, after a review, Sebi in its latest order said the entities under scanner were indeed related parties, but it could not conclude that RPIL and its parent RIL were insiders "in absence of any evidence by the investigating authority to establish the access of UPSI (unpublished price-sensitive information)... while trading in the scrip of IPCL".

As a result, "It can be concluded that the noticee (RPIL) has not violated provisions of the prevention of insider trading regulations," and are not liable to any monetary penalty, Sebi said in its 50-page order released on Tuesday.

Following Sebi's earlier order in 2013, RPIL had approached the Securities Appellate Tribunal (SAT), which had ruled that the regulator's order was "passed merely on the basis of presumption without considering the arguments advanced on behalf of the appellant to rebut the presumption".

The SAT had directed Sebi to pass a fresh order on merit and in accordance with law.