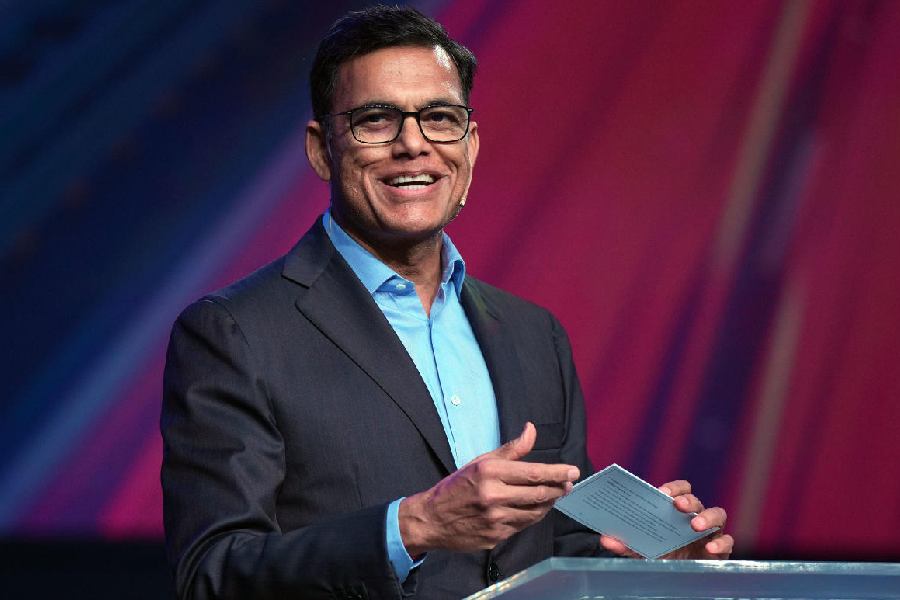

Sajjan Jindal, chairman and managing director of JSW Steel, has called for a ‘longer term solution’ to create a level playing field against ‘unfair steel imports’ that are finding their way into India.

Jindal, who reiterated his pledge to reach a steel-making capacity of 50 million tonnes by FY31, said such a move would allow Indian steelmakers to earn a reasonable return on investments.

Addressing shareholders in the company’s annual report, Jindal referred to the uncertainties caused by the tariff measures announced by the Trump administration.

The US now charges a 50 per cent tariff on steel and products made thereof, creating significant trade diversions.

“Trade barriers have been rising, with various countries either imposing measures or initiating action to protect their steel industries from unfair imports. This is altering global trade flows with surplus steel finding its way into India, posing significant challenges for Indian steel makers,” Jindal wrote to shareholders.

He observed that the finance ministry has imposed an interim safeguard duty of 12 per cent for 200 days based on the recommendation of the Director-General of Trade Remedies (DGTR).

“We believe a longer-term solution is critical to ensure the competitiveness of Indian steel, create a level playing field, and allow Indian steel makers to earn a reasonable return on investment,” he said.

A ‘reasonable’ return on investment is crucial to ensure the company makes enough money to create capacities without stretching the balance sheet.

Concerns were being raised by the industry prior to the imposition of safeguard duty that cash flow was not supportive to take up large-scale capex.

Jindal, however, reiterated that JSW would scale up domestic capacities from 34.2 mt at present to 50 mt by 2030-31.

The company, however, will remain focused on cost efficiency while scaling up operations, Jayant Acharya, joint managing director & CEO of JSW Steel noted.

“We are entering a phase where incremental volume growth will be underpinned by cost efficiencies and operational leverage from our brownfield and greenfield assets,” Acharya said.