Mumbai, July 9: The Reserve Bank of India (RBI) today revised the rules for the acquisition or transfer of control of non-banking finance companies (NBFCs).

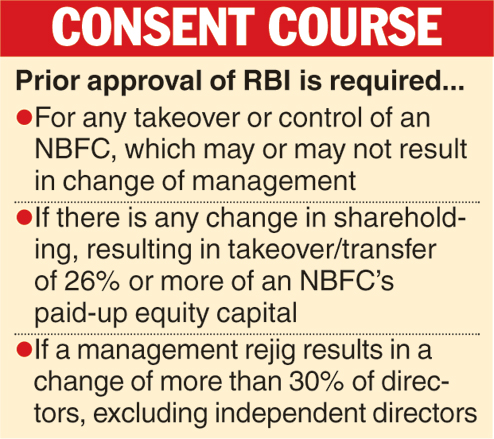

In a circular today, the central bank said its approval would be required for any takeover or control of an NBFC, which may or may not result in the change of management.

Further, NBFCs will also have to approach the RBI if there is any change in their shareholding.

According to the RBI, this will include progressive increases over time resulting in acquisitionransfer of shareholding of 26 per cent or more of the paid-up equity capital of an NBFC.

However, prior permission will not be required if the shareholding of any entity goes beyond 26 per cent because of buyback of shares or reduction in capital, following the approval of a competent court. But this should be reported to the RBI within one month of its occurrence.

Prior approval will also be required if any change in the management of an NBFC results in a change in more than 30 per cent of the directors, excluding independent directors. No approval will be required for directors who get re-elected on retirement by rotation.

In a circular today, the apex bank said it was making these changes following representations received by the industry.

The RBI has also strengthened the disclosure requirements for takeovers.

The NBFCs have been told to provide the sources of funds of the incoming shareholders acquiring the shares, declaration by the proposed directors or shareholders that they are not associated with any unincorporated body that is accepting deposits and a declaration by the proposed directors that they are not associated with any company whose application for certificate of registration has been rejected by the RBI.

The RBI also made the reporting of returns of NBFCs with asset size below Rs 500 crore more stringent under which all non-deposit taking NBFCs are required to submit an annual return to the RBI. The apex bank has created two new return formats to capture important financial parameters of the respective categories of NBFCs. The annual returns should be submitted within 30 days of closing of a financial year, that is by April 30 every year.