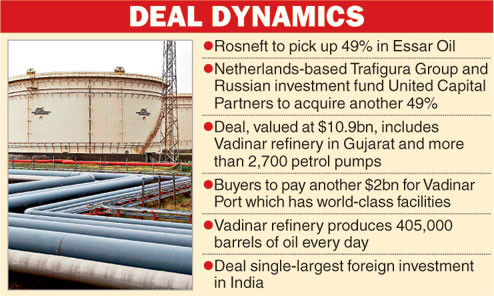

Mumbai, Oct. 15: The Essar group will sell its 98 per cent stake in Essar Oil Ltd to Russia's Rosneft and a consortium of Trafigura Group and United Capital Partners for an enterprise value of Rs 72,800 crore ($10.9 billion).

An additional Rs 13,300 crore ($2 billion) will be paid by the same buyers for the Vadinar Port, which has world-class storage and import-export facilities, thus taking the total deal size to around $13 billion.

Money raised from the transaction is expected to help the group reduce its debt of nearly Rs 80,000 crore by half.

The deal was announced at the BRICS summit in Goa in the presence of Prime Minister Narendra Modi and Russian President Vladimir Putin.

As part of the transaction, Essar Energy Holdings Ltd and Oil Bidco (Mauritius) Ltd - the controlling shareholders of Essar Oil - have entered into separate definitive agreements.

The first sale and purchase agreement involves the sale of 49 per cent to Petrol Complex Pte Ltd, a subsidiary of Rosneft. The second deal envisages the sale of the remaining 49 per cent to Kesani Enterprises Company Ltd, owned by a consortium led by Trafigura and United Capital Partners. The Essar group will hold the remaining 2 per cent in the company.

United Capital is an independent, private investment group established in 2006 to manage the assets of its partners and co-investors. Trafigura is one of the largest physical commodity trading groups in the world.

The all-cash deal includes Essar Oil's 20-million-tonne Vadinar refinery in Gujarat and over 2,700 petrol pumps.

The Vadinar facility, which accounts for 9 per cent of India's refining output, is also supported by a 1,010MW captive power plant.

The deal factors in Essar Oil's debt of about $4.5 billion and about $2-billion debt with the port company. Also, around $3-billion dues to Iran for past oil purchases will continue to be on Essar Oil's books.

"It is a historic day for Essar. The transaction demonstrates our unique ability to build world-class assets and create immense value in our businesses. The monetisation of our stake in Essar Oil will help drive the next level of growth for our other businesses," Essar group chairman Shashi Ruia said.

The parties expect to obtain the necessary approvals before the end of this year.

The acquisition is the single-largest foreign direct investment in India. It is also Russia's largest outbound deal.

Essar group director Prashant Ruia said Rosneft would continue to use the Essar brand for the retail operations. "We have signed a branding agreement under which retail outlets will continue to use the Essar brand because it is a very strong brand."

"We are not exiting the oil and gas business. We own and operate the Stanlow refinery in UK which is a 12-million-tonne unit with a 12-13 per cent market share. Also, the upstream exploration and production business is not part of the deal," Ruia said.

It is felt that the deal will give the new stakeholders a strong foothold in the Indian market, which is set to witness strong demand for petroleum products over the long term.

Refined petroleum products in India is expected to grow 5-7 per cent in the next five years.

"This deal is the largest foreign acquisition in India. It proves the attractiveness of the Indian energy market to foreign investors as India is one of the fastest growing fuel consuming economies in the world. This deal is also a significant step in the process of deleveraging the balance sheets of Indian corporates," Chanda Kochhar, managing director & CEO of ICICI Bank, said.