Jane Street, the New York-based hedge fund, is likely to argue that its options trade strategy, which resulted in “unlawful gains” of ₹4,843.57 crore, were in response to outsized demand from retail investors, Bloomberg reported on Tuesday.

In an interim order dated July 3, 2025, capital markets regulator Sebi had barred the Jane Street group from accessing the Indian securities market and directed the group entities to open an escrow account and deposit the gains made by engaging in “illegal manipulation” of securities that comprised of Bank Nifty and Nifty indices.

Sebi subsequently lifted the trading ban on Jane Street on July 21 and allowed the company to resume trading after it deposited the mandated ₹4,853.57 crore according to the directive.

Jane Street on Monday said that it has asked for more time to respond to the accusations. Sebi in its interim order had allowed 21 days to respond to its 105-page order.

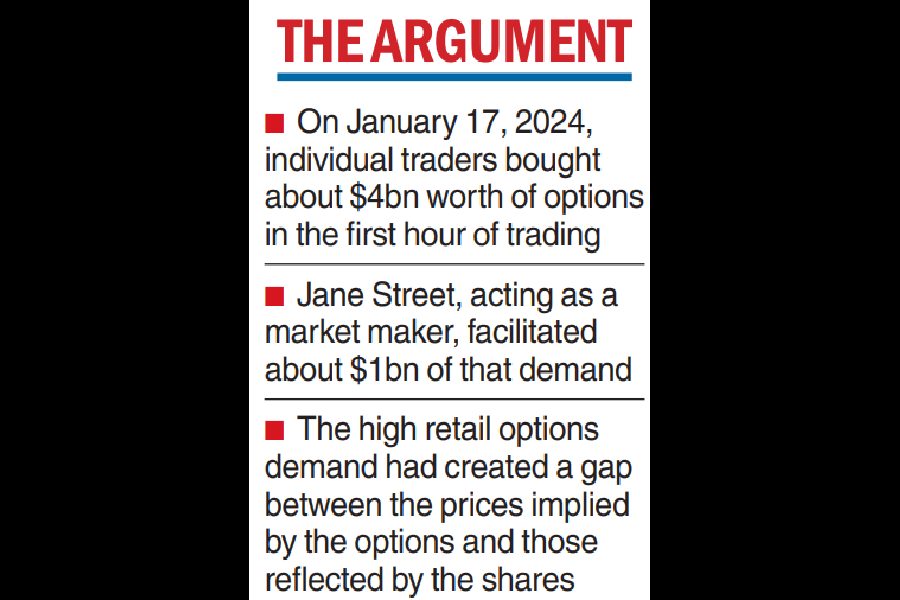

Jane Street is expected to argue that high retail demand for options on the Bank Nifty index was a key driver behind its trading on January 17, 2024, which was the firm’s most profitable day, over a roughly two-year period that the regulator scrutinised.

The firm will likely argue that individual traders bought about $4 billion worth of options in the first hour of trading and Jane Street, acting as a market maker, facilitated about $1 billion of that demand, Bloomberg reported citing people familiar with the matter. The high retail options demand had created a gap between the prices implied by the options and those reflected by the shares.

Sebi’s accusation

Sebi in its interim order had said that Jane Street had accumulated large volumes of constituent stocks of the Bank Nifty in the cash and futures market, thus pushing up the index prices. Simultaneously it took short positions in the derivatives segment by buying cheap “put” options and selling expensive “call” options linked to Bank Nifty.

In the second half of most of the days in which Jane Street’s positions were studied, the US firm reversed the first leg of its trade, selling the constituents in the cash and futures market, pushing down the prices of the index. This in turn led to a rise in value for the “put” option and a drop in value for “call” options, earning Jane Street profits, which outweighed any loss incurred during the first leg of the trade.

Sebi has said that such trading patterns created a “false or misleading appearance of market activity” and attracted unsuspecting investors to trade at levels that were “artificial and temporary”.

Jane Street in an internal email to its employees had earlier said that activities in question were known as arbitrage trade, which is commonly used by large trading firms globally.