Mumbai, April 23: The Reserve Bank of India today included advances made to small and marginal farmers under priority sector lending.

The move comes in the backdrop of farmer suicides following crop damage caused by the unseasonal rains and hailstorms.

Small and marginal farmers constitute more than 80 per cent of the agrarian households in the country.

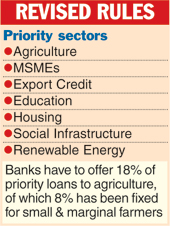

The RBI directive is part of the revised priority sector lending norms, which will be effective from today. Banks have to provide close to 40 per cent of their advances to certain specified segments called priority sectors.

The apex bank has accepted the recommendation of an internal working group, set up in July last year, to include medium enterprises, social infrastructure and renewable energy in the priority sector.

The RBI has also done away with the difference between direct and indirect agriculture, and loans to food and agro-processing units will form part of agriculture.

The RBI has retained the priority lending target at 40 per cent of which 18 per cent have been fixed for agriculture. Within the 18 per cent, a sub-target of 8 per cent has been fixed for small and marginal farmers. This target has to be met in a phased manner - 7 per cent by March 2016 and 8 per cent by March 2017.

The RBI also raised the priority sector target for foreign banks. It said foreign banks with 20 branches and above would have to comply with the 40-per-cent rule (along with sub-targets) by March 31, 2018.

However, foreign banks with less than 20 branches have been given time till 2019-20.