Risk and reward go hand in hand. That age-old quip has been underscored yet again by the Securities and Exchange Board of India (Sebi), which has recently introduced a rather special method of depicting the level of risk for mutual fund investors.

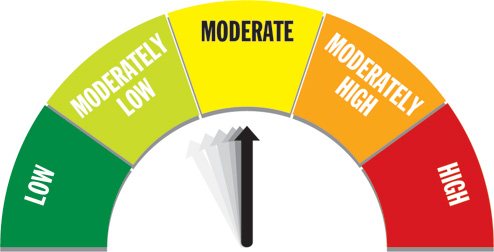

Riskometer, as it has been labelled, is a pictorial representation of the risk carried by a fund. (See diagram).

Sebi has defined five levels of risk in relation to the principal invested by an investor. These are:

- Low

- Moderately Low

- Moderate

- Moderately High

- High

The Sebi initiative, which will take effect from July, will apply to all existing funds and those that will be introduced in the future. Asset management companies are free to introduce it before the effective date.

In 2013, the securities watchdog had introduced a more rudimentary form of "product labelling" for fund investors. It used three colours - blue, yellow and brown - to indicate the comparative levels of risk.

The Riskometer has replaced the practice of colour-coding. The old colour code, it was hoped then, would address the issue of mis-selling of funds, at least in the long run. Also, it was meant to provide investors with a convenient and useful tool - one that would enable them to understand the very nature of funds.

This, in turn, brings us to a central issue: Are investors fully aware of the risk they face when they invest in mutual funds? After all, there are a great many funds to choose from, managed by more than 40 different asset management companies. Their sheer variety and diversity can confuse the ordinary investor.

Key questions

Every investor has his own unique needs, income, financial obligations and other limitations. His risk-level, by definition, is unique too. Not all kinds of funds will be suitable for him. Therefore, "product suitability" is for him a major factor to reckon with.

In this connection, the following posers are critical:

- What is the level of risk that you are willing to tolerate?

- What should be the ideal nature of the fund you should invest in?

- For how long should you stay invested?

An investor who seeks, say, merely capital appreciation will need to keep this specific requirement in mind before he selects his fund as he has to create wealth over time.

Another investor may want regular income, which he thinks will be a big source of sustenance for him. The frequency and stability of income will be a key criteria for the second investor. Each of the two prerequisites is unique - and, so should be the nature of funds chosen by the two investors.

Yes, time horizon is the essence here. A relatively young individual has age on his side, and can ideally stay invested for many years.

An older person - imagine someone who has retired already - may not have such a luxury. Whether you should allocate for the short, medium or long term in a particular fund is a very important matter to consider.

Look closely

Loosely speaking, risk can be defined as anything that undermines the probability of reaping rewards. Risk, with regard to capital (that is, principal), is clearly a big consideration for any investor. A fund can be labelled as truly "risky" if the investor fails to get back his principal at the end of the fund tenure.

It is important to categorically underline the significance of a fund's investment objective, the strategy for building the portfolio and asset mix. You need to ask questions like is the fund equity-oriented with some scope for investing in debt? Or, is it primarily driven by debt with little or no room for equity? Or, further, is the fund diversified across various asset classes? Once you find the answers to such vital questions, you will have a clear idea about the nature of the fund.

A fund that is potentially risky is almost surely faced with a lot of volatility within its investment universe. The latter, for all practical purposes, may be marked by constant upheavals. Such upheavals may be felt more acutely over short periods of time. Not all investors will have the appetite for a product of this nature. If you stay deliberately invested in it, you will easily be identifiable as a risk-taking investor.

Your allocation must be in sync with your risk tolerance. A high-risk fund will deliver high returns - but only a brave and lucky investor will be able to fully leverage such a product repeatedly.

Choice is supreme

At the time of investing in a fund, you should familiarise yourself with its salient features, including the fund manager's investment style and rationale.

At the end of the day, choice becomes supreme. Your investment decisions should be based on many important factors; risk must be given the significance it deserves.

Not taking enough risk will probably scale down your potential reward. However, taking a lot of risk may well lead to losses, damaging your plans to create wealth or even securing stable income over time.

The author is director of Wishlist Capital Advisors