Prime Minister Narendra Modi on Tuesday said the government would take more measures to tame inflation, a day after retail inflation data showed it surged to a 15-month high of 7.44 per cent.

Economists said the government would be forced to micro-manage prices, use buffer stocks and could resort to imports to contain prices.

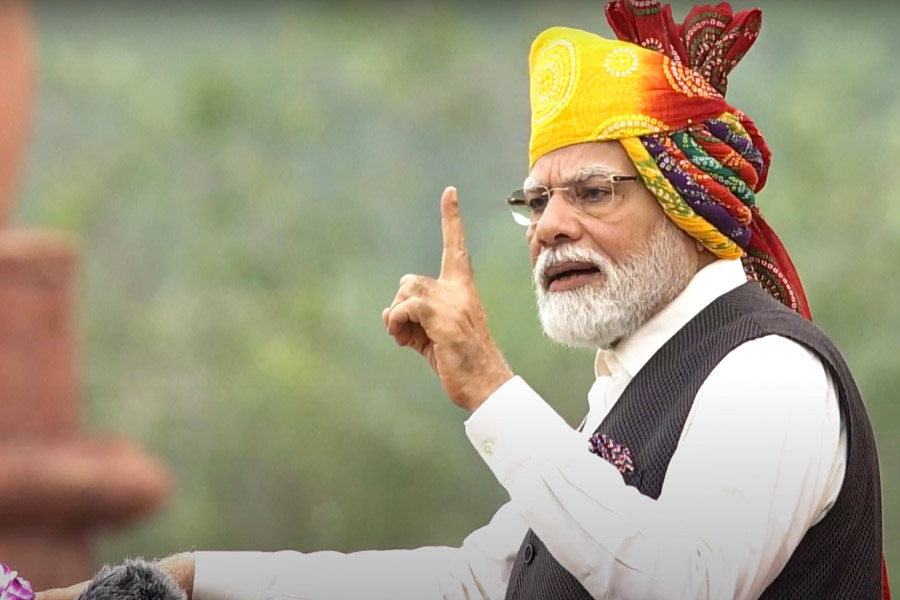

“We have to take more steps to minimise the burden of inflation to the people of the country,” Modi said in his Independence Day address from the ramparts of the 17th-century Red Fort here. “And we will definitely take steps. Our efforts will continue.” However, he did not spell out the measures in his speech.

Economists and even the Reserve Bank of India (RBI) expect inflation to remain elevated over the next couple of months because of the impact of erratic weather conditions and the El Nino phenomenon on crop production.

The price rise could pose a worry for the ruling BJP-led NDA government, with the upcoming general election in 2024. In addition, some key state assembly elections are also coming up, and the BJP would be keen to retain power in some of the big heartland states.

Food-driven inflation is always a concern for political parties in power in the country. They have in the past lost elections because they could not control the price of essential items such as onions — a staple in the diets in the world’s most populous nation.

Controlling inflation is a top priority for the Union government as high prices pose a challenge to growth and macroeconomic stability. Elevated food prices, especially of cereals, pulses and vegetables, have hammered household budgets.

N.R. Bhanumurthy, vice-chancellor, Dr BR Ambedkar School of Economics University, said “the government would be forced to micro-manage prices and could use buffer stocks and import cereals and pulses to tame the inflationary pressure in the economy”.

“We expect higher food inflation to have a negative impact on growth since food demand tends to be price inelastic and higher food prices are likely to squeeze real disposable incomes and weaken demand of lower-income households,” Sonal Varma of Nomura said.

Sources said the government is studying allowing wheat import with a 15 per cent duty or reducing it to zero.

Currently, a total of 40 per cent of customs duty is imposed on wheat imports.

Tomato is being imported from Nepal by lifting import restrictions. Pulses prices have spiked in the past few weeks. Tur import is higher than last year and consignment from Mozambique is on the way. Urad is being imported from Myanmar. Three lakh tonnes of onion have been added to buffer stock to counter any possible price rise.

The area under paddy has been completed in over 80 per cent of the normal area. It is 5 per cent more than the acreage in the year-ago period. The overall acreage of all kharif crops has reached about 90 per cent of the normal area of 1,091.73 lakh hectares (lh). It is higher by 1 per cent from a year ago, the latest data from the agriculture ministry showed.

The total area under pulses declined eight per cent to 113.07 lh from 122.77 lh. Moong (green gram) was covered on 30.03 lh (-7.3 per cent), urad in 29.55 lh (-13.5 per cent) and arhar in 40.27 lh (-5.4 per cent).

Modi’s remarks came a day after retail inflation data showed that food inflation, which accounts for nearly half of the overall consumer price basket, rose at a staggering pace of 11.51 per cent in June compared with 4.49 per cent in June. Retail food inflation was at its highest since January 2020, when it was over 13 per cent.

Vegetable inflation rose a whopping 37.34 per cent after a fall of 1 per cent in the previous month.