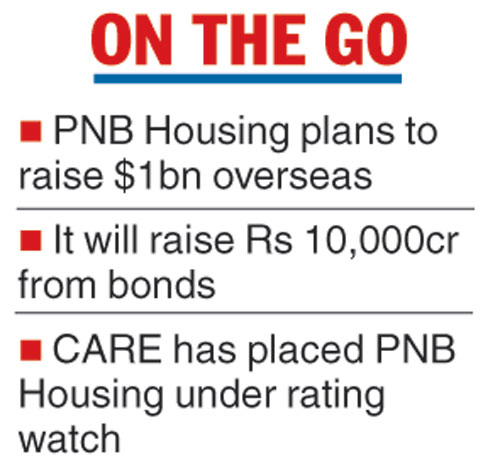

PNB Housing Finance on Thursday said it planned to raise up to $1 billion (around Rs 6,954 crore) from the overseas markets apart from an additional Rs 10,000 crore by issuing bonds.

The fund raising move comes days after CARE Ratings placed various facilities of the housing finance company under “credit watch”.

The PNB Housing board will meet on May 9 to consider the results for the quarter ended March 31, 2019. The board will also consider the fund raising proposals.

PNB Housing told the bourses the board would take up approval of 'fund raising by way of external commercial borrowings up to $1 billion in one or more tranches”. Besides, the board will decide on the issue of secured and unsecured non-convertible debentures aggregating up to Rs 10,000 crore, in tranches.

CARE said the ratings assigned to the long-term instruments or bank facilities of the company are under credit watch with developing implications, in view of the capital-raising requirements, which are critical for it to maintain comfortable capital adequacy and gearing levels, while achieving target growth.

The Telegraph

CARE pointed out to the increasing share of the corporate loan book in PNB Housing Finance’s total loan portfolio and the consequent vulnerability arising out of the weakness in the real estate sector.

It said the ratings of PNB Housing benefited from its experienced management team, brand linkages with PNB, the promoter of the company and the consistent growth in the loan portfolio.

PNB Housing had other factors going for it such as profitability profile of the company, comfortable asset quality numbers, maintenance of adequate capitalisation levels and adequate liquidity position. However, it said the ability of the housing finance company to maintain its asset quality, profitability, capital adequacy and liquidity position remain key rating sensitivities.

The bad loans for the wholesale loan book of PNB Housing Finance was nil as of December 31, 2018. But its overall vulnerability, which forms nearly 22 per cent share of AUM, is expected to remain relatively high and could impact the asset quality profile to some extent over the next 1-3 years.

The news led to shares of PNB Housing Finance finishing weaker on Thursday. On the BSE, the scrip ended 4 per cent at Rs 683.55.