Mumbai: The Reserve Bank of India (RBI) on Wednesday said it had incurred lower expenditure on the printing of notes in 2017-18, resulting in its total expenditure falling over 9 per cent compared with the preceding year.

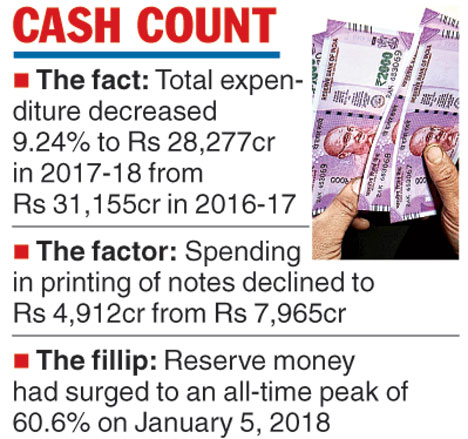

In its annual report, the central bank, which follows a July-June financial year, said its total expenditure decreased 9.24 per cent to Rs 28,277 crore in 2017-18 from Rs 31,155 crore in 2016-17 primarily because of the decrease in expenditure on printing notes.

The expenditure on the printing of notes declined to Rs 4,912 crore from Rs 7,965 crore in the previous year.

The RBI said during the year, the reserve money (RM - which includes currency in circulation and banks deposit with the RBI) was largely conditioned by the remonetisation of currencies that included the newly designed Rs 10, Rs 50, Rs 200, Rs 500 and Rs 2000 notes.

The central bank added that the impact of demonetisation had initially seen the reserve money growth plunging.

However, as it went into a remonetisation overdrive, this resulted in the growth of reserve money surging to an all-time peak of 60.6 per cent on January 5, 2018, before moderating to around 27 per cent as on March 31, 2018.

The RBI further disclosed that the reserve money growth was 21.1 per cent as on June 29.

In April, various states had witnessed currency shortage. However, the RBI had then said that there was no currency shortage and there was sufficient cash in its vaults and currency chests.

Even as the debate over demonetisation rages on, a report from the SBI said that as a result of the November 2016 move, there has been a considerable increase in the number of income tax returns.

The number of returns filed as on July 31, 2018, stood at 3.43 crore against 2.24 crore filed during the corresponding period of the previous year, an increase of 53 per cent.

This increase in filing, it added, will garner an extra tax revenue for the government.