"Success does not consist in never making mistakes but in never making the same one a second time"

These lines, attributed to George Bernard Shaw (not that the great author had a lot to do with investments), pretty well sums up what we will try to do in this column. We will discuss mistakes that investors often commit and ways to avoid making them again.

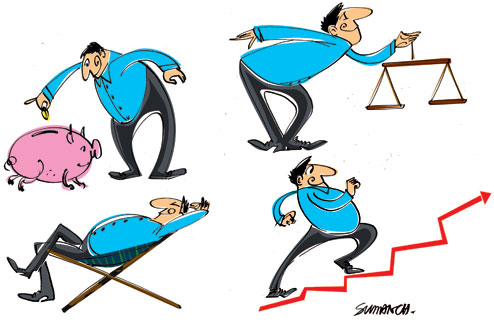

I have identified four classical areas that you need to watch out for. My list of slip-ups goes like this:

• Not starting early and not investing regularly

• Trying to time the market, forever waiting for the best opportunity

• Not re-balancing one's portfolio in line with big changes in life-stage

• Not planning for retirement

Let's now discuss these one by one. Remember, these have been placed in no particular order and you are free to set your own priorities.

Follow a method

The two infallible laws of investing can be expressed in simple words - start early and invest methodically. An investor who has followed these tenets is likely to do well, especially so if he has done it for the long term, across market cycles. And one of the best ways to do this is initiating systematic investment plans (SIPs) in managed products (such as mutual funds).

An SIP allows the concept of Rupee Cost Averaging, wherein the cost of acquisition of units turns more tolerable for the investor over a period of time. In the modern-day unitised scenario, the chain of his investments (typically monthly or quarterly) can lead to a very decent corpus.

Don't time

Do it now, do not be too patient and wait for the next best opportunity. You will only end up losing time, and the kind of super profits you are expecting may not transpire at all. The mantra, therefore, is to do it right away, provided such a step would be in sync with your risk appetite.

Risk appetite, simply put, refers to the kind of risk you can take, given your financial standing. This will ultimately determine the nature and mix of assets you can acquire. Your age, current income, liabilities and so on are major considerations here.

Start an SIP (or more) today if you have made up your mind with regard to your risk-bearing capacity. How much money can you spare, say, every month? In which financial products should you invest? How will you distribute your investments? You will need answers to these questions.

Life stage planning

This is quite a broad term, which disciplined investors practise all over the world.

The idea is to plan, financially speaking of course, for various stages of one's life. The plan required by a young adult (early in his career, with fewer obligations, seeking growth of capital) will be different from that by a middle-aged individual (staring at retirement, burdened with major responsibilities, seeking income flows). A retired and aged person will have to cope with huge costs (related to healthcare in particular) and, as it frequently happens in the real world, the stark reality that he has no active income any longer.

The point is, life stages keep changing with time. Marriages, child-births, job-hops and divorces often have huge financial implications. Asset allocation, it follows naturally, must also be revised accordingly. Altering the asset-mix in your portfolio is the most prudent course of action for smart investors.

A young person will typically build an aggressive portfolio, keeping in view his need to enlarge his capital, even at the cost of assuming greater risk. Equity, a relatively risky asset class, will probably be his obvious choice. An older person, however, will be perchance more conservative in nature. He will, in my view, look for debt securities in order to ensure a steady income.

The debt-equity blend will vary. There is no asset allocation that will universally fit all investors. In many cases, personal choices come to the fore, driven by considerations that are not strictly pecuniary in character. At the end of the day, each human being is unique with multiple wants but limited resources.

What are you waiting for?

Well, if some of the scarier news headlines in January have spooked you to a stupor, do not waste the remaining days of February. In other words, do not keep surplus money in savings accounts, which, incidentally, are offering you only 4 per cent interest. And if you have done so needlessly, you have lost the following:

Interest, if you are a fixed-income person keen on guaranteed products like FDs and bonds.

Cheaper units , as the market declined because of various reasons. I am referring to the equity funds here; not a lot changed in the debt market.

Cheaper stocks , as many counters recorded a decline in valuations. These may have included the bluechips that you have always wanted to acquire in larger numbers.

If you have reached the last paragraph of this column, this is just the right time to renew that old pledge -no more mistakes. Go to work, list your financial objectives, consider your expenses, plan your portfolio and, remember, you need to beat the combined effects of taxes and inflation to stay in the game.

The author is director, Wishlist Capital Advisors