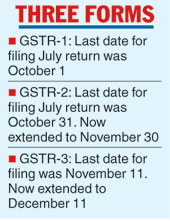

New Delhi: The government has extended the due date by a month for the filing of July GSTR-2 to November 30 and GSTR-3 to December 11. The extension will help about 30.81 lakh taxpayers, the finance ministry said in a statement.

"The extension of the timelines to file both GSTR 2 and GSTR 3 by one more month could improve compliance by taxpayers as they now have more time to file match input tax credits, take remedial action for mismatches and file accurate returns for July," M.S. Mani, partner at Deloitte India, said.

"A high-level panel of state finance ministers on GST has suggested various such reforms, which are expected to be considered in the next GST Council meeting on November 10 and if most of the changes suggested are implemented, it would lead to more taxpayers filing their returns within the extended timelines," he said.

The GSTR-2, or purchase returns, have to be matched with the GSTR-1, which is the sales return. The original due date for filing GSTR-2 was October 31, while the last date for filing of GSTR-3, which is a matching form of GSTR-1 and 2, was November 11.

The last date for filing of GSTR-1 for July was October 1. Over 46.54 lakh businesses had filed July GSTR-1.

Businesses have been complaining of problems in matching invoices while filing GSTR-2 on the GST Network portal. This is the first month of filing GSTR-2.

Abhishek Jain, tax partner of EY India, said: "The extension will help to reduce the anxiety among industry players on account of challenges faced in filing GSTR 2 and the fact that the government utility for filing the same was released only a few days back."

Input tax credit can be claimed after returns are filed, analysts said adding that businesses should file ahead of the deadline, so that they do not lock up funds.

MRP row

Maximum retail price of goods must include the GST component to address consumer complaints that some retailers charge the new indirect tax on MRP of products, the panel has recommended. The group of ministers, headed by Assam finance minister Himanta Biswa Sarma, has suggested that the government make it amply clear in the present law that MRP is the maximum price of a product to be sold in retail and charging anything above this is an offence.

This rule, sources said, must be applicable to establishments such as restaurants and malls that sell packaged goods such as bottled beverages which already carry an MRP. However, at some places a GST is charged over and above that MRP.