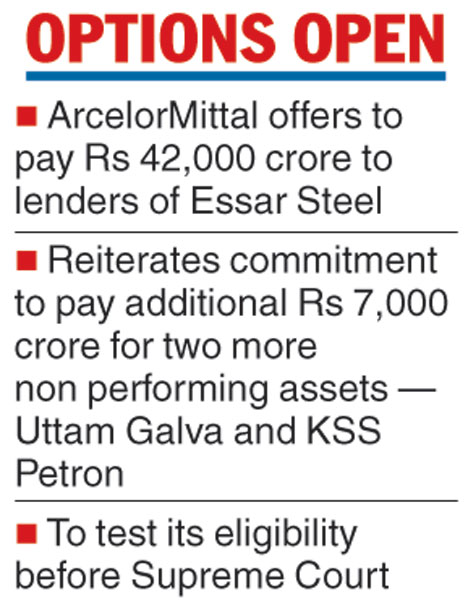

Calcutta: ArcelorMittal remained in the hunt for a possible entry into the world's potentially fastest growing steel market by offering to pay a whopping Rs 42,000 crore to the lenders of Essar Steel even as it decided to test its eligibility before the Supreme Court.

On Monday afternoon, the world's largest steel producer decided to revise its bid for Essar and reiterated its commitment to pay an additional Rs 7,000 crore for two more non-performing assets.

Put together, the financial terms of the offer represented "unprecedented value for all concerned creditors", ArcelorMittal (AM) said in a statement.

Essar, promoted by brothers Shashi and Ravi Ruia, owes Rs 49,343 crore to creditors. AM's proposal is now equal to the principal amount Essar owes to the secured creditors.

"ArcelorMittal confirms that it has on Monday submitted a revised proposal to Essar Steel's (ESIL) committee of creditors for the acquisition of ESIL. The financial terms of the proposal are confidential, but represent a material increase to the previous offers made by the company. The revised offer, which includes a commitment to pay the entire amount due to the financial creditors of Uttam Galva and KSS Petron, therefore, represents unprecedented value to all creditors concerned. Through the revised offer ArcelorMittal demonstrates its commitment to India, creditor banks and all ESIL's stakeholders," AM said.

By the evening, it become clear that AM would exhaust all legal options before making its payment for Uttam Galva Steels and KSS Petron. The letter sent by AM to Essar's resolution professional Satish Gupta, with a copy to the CoC, suggested the same.

The NCLAT, in its order on Friday, had held AM ineligible as a resolution applicant as it held two non-performing accounts UG and KSS and asked the lenders to consider AM's offer only when it paid its dues to these accounts and charges thereof by September 11.

However, it would not be easy for AM to get a stay on the NCLAT order before Tuesday's deadline as Numetal had already filed a caveat in the apex court and, hence, notices must be served to it, which is a time consuming process.

Conditional offer

In the letter, AM asked the lenders to confirm the amount due on account of UG and KSS and the modality for making the payment. AM had previously parked Rs 7,000 crore in a current account on account of UG & KSS but never transferred it.

The letter sent on Monday read: "ArcelorMittal's proposal must in no way be construed as an admission of the purported ineligibility of any companies in AM Group to submit a resolution plan in IBC or otherwise, nor its derogation of right to avail of appellate remedy against the order."

The company, owned by Lakshmi Niwas Mittal, further added: "We continue to believe that we are and have always been eligible to submit bid for Essar Steel and reserve all rights in respect to any finding to the contrary, including by the honourable NCLAT."

Sources said the CoC could not consider the fresh proposal from AM yet because the company was not an eligible applicant before making its due payment. "It appears AM wants to be sure that it is getting ESIL before actually paying up," corporate observers said.

Big bet

Keeping aside the legalese that may ensue, AM certainly upped the game on Monday, at least on paper. When the CoC met on Monday to open the second round bid, it found the Numetal consortium offering Rs 37,000 crore against Rs 35,000 crore by AM and Rs 34,000 crore of Vedanta. It would now be impossible for the CoC to bring the benchmark lower. Even if AM does not get Essar, lenders may be wary of settling for anything less. This could mean higher acquisition costs for Numetal and Vedanta.

At Rs 49,000 crore, AM is agreeing to pay Rs 6,000 crore per million tonne of steel capacity, nearly as much as building a new plant. The numbers may be justified given that it had not been able to create any capacity in India where demand is expected to grow in high single digits for next 15 years.

Moreover, AM could hardly acquire any more assets elsewhere without falling foul of anti-trust rules, as was evident during the acquisition of Ilva in Italy.