The Telegraph

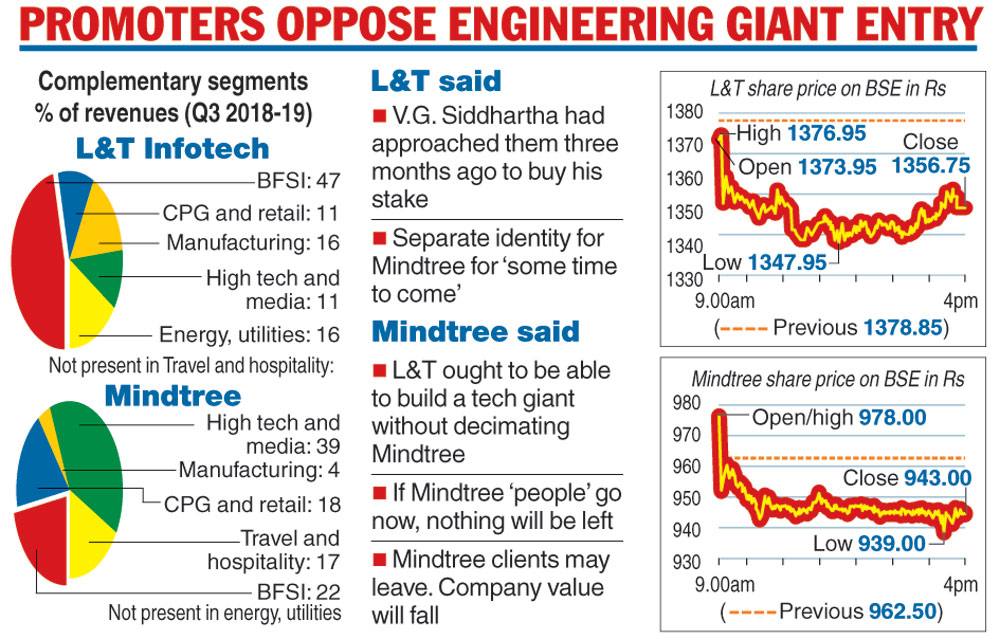

Larsen and Toubro, the Rs 118,000-crore engineering, construction and financial services behemoth, on Tuesday said it had no intention to swallow Bangalore-based Mindtree even as it cobbled a strategy to pick up a 66 per cent stake in the Rs 5,400-crore technology minnow for which it has put together a Rs 10,773-crore war chest.

The L&T honchos tried to cool the frazzled nerves of Mindtree’s promoters by trying to suggest that their overture — which had begun with the acquisition of Coffee Café day promoter V.G. Siddhartha’s 20.32 per cent stake -— ought not to be characterised as an aggressive, predatory bid.

S. N. Subrahmanyan, L&T managing director and chief executive, came up with a cheesy line that would resonate better in a Bollywood film than a corporate feud when he said that the stake buyout plan had been made with “dil and pyaar” (heart and love) and that they hoped to eventually win over Mindtree’s rattled but furious promoters. Subrahmanyan said: “There are some emotions and trepidations… but emotions have to be overcome as we go forward. The senior people in the management are (our) personal friends, good people, men of repute and who have done their best to get Mindtree to where it is today. We feel a lot of positivity and sync in the way to go forward.”

The focus will now shift to Mindtree’s board meeting tomorrow, which is scheduled to discuss a proposal for a buyback of shares. It remains to be seen whether the mid-tier technology company will adopt a poison pill strategy, or find a white knight, to thwart the L&T takeover attempt.

The L&T chief executive said the deal was triggered after Mindtree’s largest shareholder, V.G. Siddhartha, approached them three months ago with an offer to sell his shares. Subrahmanyan claimed that L&T saw the Mindtree deal as an opportunity to deploy a substantial part of the Rs 15,000-crore cash mountain it currently sits on.

The acquisition of the 20.3 per cent stake held by Siddhartha and two other entities will cost Rs 3,269 crore at Rs 980 per share.

L&T has simultaneously announced plans to stump up Rs 5,030 crore to back an open offer to buy up to 31 per cent – a little over 5 crore shares – from existing shareholders.

It has also asked its brokers to scoop up another 15 per cent through open market purchases, which will cost another Rs 24,34 crore.

Blunt talk

However, A.M. Naik, L&T group’s executive chairman who has never been known to mince his words, growled on a television channel: “Why are they (the Mindtree promoters) classifying it as a hostile takeover? If we don’t take over, someone else will.”

Naik, who had famously fought off a bid by Dhirubhai Ambani’s Reliance Industries to take over L&T in the mid-nineties, said there were no immediate plans to merge Mindtree with L&T group subsidiary, L&T Infotech which had reported consolidated revenues of Rs 7,306 crore in the year ended March 2018.

Mindtree, the mid-sized technology company, had revenues of Rs 5,462.80 crore in the same period.

Subrahmanyan refused to say whether L&T would automatically take over Siddhartha's board seat on Mindtree. He also fobbed off a reporter who wanted to know whether the engineering giant would raise its open offer price of Rs 980 per share if a bidding war erupted.

Promoters dig in

The promoters of Mindtree have strongly opposed L&T’s bid and asked why L&T could not build a great technology business on its own.

They wondered what kind of a message was being sent to start-ups and credible entrepreneurs with the first hostile takeover attempt in the Indian technology sector.

Posing five questions to the potential acquirer, the promoters wanted to know what would happen if Mindtree employees decide to leave after the takeover.

“You are a company with a turnover of Rs 1,20,000 crore; you are 18 times the size of Mindtree. Why can't you build a great technology business with your resources and capability without decimating another organisation,' Mindtree promoter and executive chairman Krishnakumar Natarajan said at a press conference in Bangalore.

In a statement, the Mindtree promoters said: “The attempted hostile takeover bid of Mindtree by L&T is a grave threat to the unique organisation we have collectively built over 20 years. A hostile takeover by L&T, unprecedented in our industry, could undo all of the progress we’ve made and immensely set our organisation back. We don’t see any strategic advantage in the transaction and strongly believe that the transaction will be value destructive for all shareholders.”

While there are reports that a couple of mutual fund houses are not enthused with the open offer, proxy advisory firm Institutional Investor Advisory Services India Ltd (IiAS) said Mindtree’s independent directors must provide objective guidance to its shareholders on whether L&T’s open offer is in the company’s long-term interest.