Mumbai: Reliance Jio (Jio) will be acquiring only half of the spectrum that Reliance Communications (R-Com) possesses - which means that the Anil Ambani-telecom entity will still have the means to keep its rump business alive.

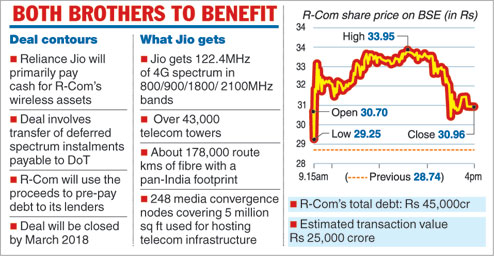

Under the terms of the deal signed between the two groups on Thursday, Reliance Jio will be acquiring 122.4MHz of 4G spectrum in the 800, 900, 1800 and 2100MHz bands.

"We are acquiring about half of the 256MHz of spectrum that Reliance Communications has," a spokesperson said.

In its annual report for 2016-17, R-Com had said it held 269MHz of spectrum across the four spectrum bands. Its sister concern, Reliance Telecom, has a little over 46MHz in eight circles, including Calcutta and Bengal.

The deal made no mention about the fate of Reliance Telecom, which has already informed the telecom regulator that it intends to close down its voice services and provide only high-speed data services in Assam, Bihar, Himachal Pradesh, Calcutta, Madhya Pradesh, the Northeast, Orissa, and Bengal from Friday (December 29).

Earlier this year, R-Com received an approval from the department of telecommunications for its merger with the wireless business of Sistema Shyam Teleservices Ltd. The deal meant that R-Com acquired another 30MHz in the 800MHz band which can be used for 4G services.

Sistema has spectrum in eight circles, including Delhi, Gujarat, Tamil Nadu, Karnataka, Kerala, Calcutta, UP-West and Bengal. This spectrum has validity up to year 2033. Most of R-Com's existing holdings in the 800MHz band are set to expire in 2021.

In earlier years, R-Com and its subsidiary Reliance Telecom had successfully bid for spectrum in 14 service areas at a total cost of Rs 4,453 crore.

The company and its subsidiary have made an upfront payment of Rs 1,158 crore under the deferred payment option.

The balance Rs 3,328 crore has been classified as a deferred payment liability.

"The balance payment of Rs 6,490 crore along with interest at 10 per cent per annum of Rs 3,195 crore is payable in 10 annual instalments starting from 2017-18," the company had said in its annual report for 2016-17.

While the entire spectrum that is being acquired by Jio is towards 4G services, observers, however, pointed out that the residual spectrum (which is not part of today's deal) could be sold to others and that more announcements can be expected in the days to come.

"This is just the first announcement relating to monetisation of our assets. More is set to come. We have received interest from various parties for the assets and as previously announced, the debt resolution will be completed by March next year," they said.

Analysts point out that while this transaction will lead to 55 per cent of R-Com's debt being wiped out, it will bring several benefits for Jio. To begin with, the Reliance Industries Ltd (RIL) subsidiary will immediately become one of the top three independent tower companies in the country.

For the period ended September 30, Bharti Infratel had more than 39,000 towers. Including its 42 per cent stake in Indus Towers, the combined infrastructure of the firm stood at 90,955 towers.

The acquisition is also expected to play a key role in Jio's next phase of growth.

"These assets are strategic in nature and are expected to contribute significantly to the large scale roll out of wireless and fibre to home and enterprise services by Jio," the company said in a statement.

Dream run

Shares of Reliance Communications continued their rally for the third straight session on Thursday, surging nearly 8 per cent following the announcement of a revival plan.

The stock soared 7.72 per cent to end at Rs 30.96 on the BSE. During the day, it had shot up 18.12 per cent to Rs 33.95.

On the NSE, it jumped 7.66 per cent to close at Rs 30.90.

In terms of equity volume, 858 lakh shares of the company were traded on the BSE and over 77 crore changed hands on the NSE during the day.