Tax advocates are worried about the implications of a significant change in the income tax (I-T) bill tabled last week in the Lok Sabha that empowers federal investigators carrying out a survey at taxpayers’ homes and offices to record a statement under oath that could be used against them in any subsequent proceedings.

The worrying tweak is in section 253(5)(b) of the Bill. It says that an Income tax authority acting under section 253 may “record the statement of any person on oath which may be useful for, or relevant to, any proceeding under this Act”.

The risk for the taxpayer is that since the statement will be recorded under oath, it could therefore gain some evidentiary value.

There is a similar provision in the existing act – section 133A(3)(iii) of Income Tax Act, 1961 – which also allows the tax authorities to record a statement. But the difference is that since it isn’t recorded under oath, courts have not attached any evidentiary value to it.

Tax advocate Narayan Jain says that the Supreme Court and various High Courts have held that a statement recorded during a survey under section 133A has no evidentiary value.

Jain said that such a view had been expressed by the Supreme Court in CIT v. Kadar Khan (2012).

Other cases included Gujarat High court verdicts in CIT v. Shardaben K Modi (2013) and CIT v. Golden Finance (2013). A similar view was expressed in CIT v. Kishore Mohan Lal Telwala (ITA No. 411 of 1999 dated 24.04.2000).

Jain said that the new provision in the IT Bill amounted to a virtual reversal of the Supreme Court’s decision in CIT v. Kadar Khan.

In that case, the assessing officer claimed that he had reason to believe that the assessee had evaded tax. He carried out a survey under section 133A during which the assessee failed to produce the required books. A sworn statement was recorded from one of the partners in which the assessee offered an additional income of Rs 20 lakh for the assessment year 2001-02 and Rs 30 lakh for AY 2002-03. This was later retracted by the assessee through a letter.

In court, counsel for the assessee argued that a statement recorded under section 133A had no evidentiary value — a view that the apex court upheld.

The power to record a statement under oath is only available under section 132(4) which pertains to a search of the premises.

The section reads: “The authorised officer may, during the course of the search or seizure, examine on oath any person who is found to be in possession or control of any books of account, documents, money, bullion, jewellery or other valuable article or thing and any statement made by such person during such examination thereafter be used in evidence in any proceeding under the Act.”

Jain contends that the powers of the tax authorities during a Survey are “lighter” and cannot be equated with the powers during a Search.

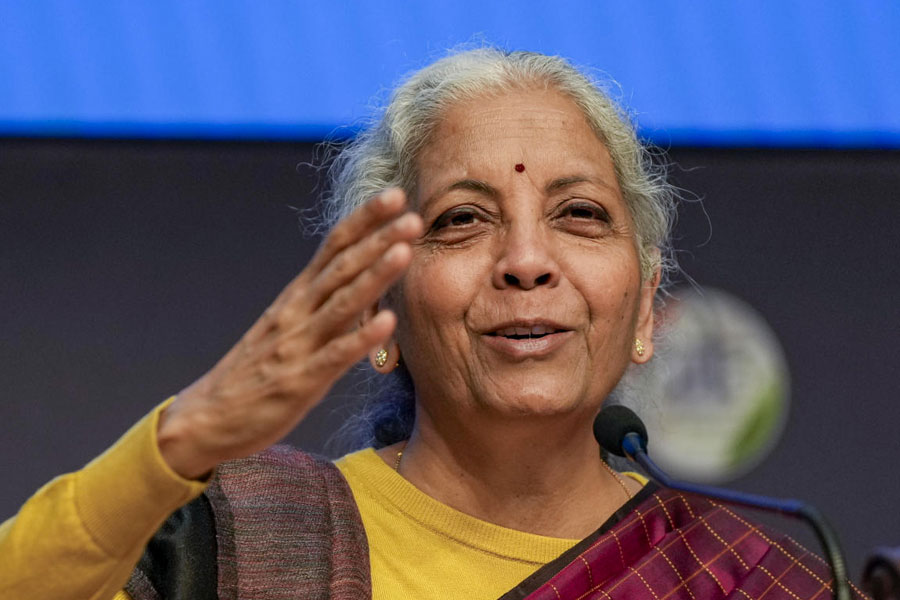

Finance minister Nirmala Sitharaman had promised that the decisions of the Courts would not be disturbed while framing the Income Tax Bill 2025, unless very necessary.

Jain has suggested the finance minister ought to amend the draft provision of section 253 and omit the power of recording statement on oath during survey.

The Bill has been referred to a 31-member select committee headed by Baijayant Panda which is expected to review its provisions before it is presented to the House for approval.