Calcutta, Sept. 2: The Employees' Provident Fund Organisation (EPFO) is planning a ranking system for exempted establishments.

Regulated by the EPFO, exempted establishments can create their own provident fund trust and administer it based on specified rules after obtaining clearances from the statutory authorities.

The EPFO now plans to evaluate the performance of these establishments and rank them. The process can take shape within three months.

"We are monitoring the performance of the exempted trusts and now we are going to rank them. These companies are supposed to credit the trust with the amount every month before the 15th. They have to invest according to set guidelines and earn the return.

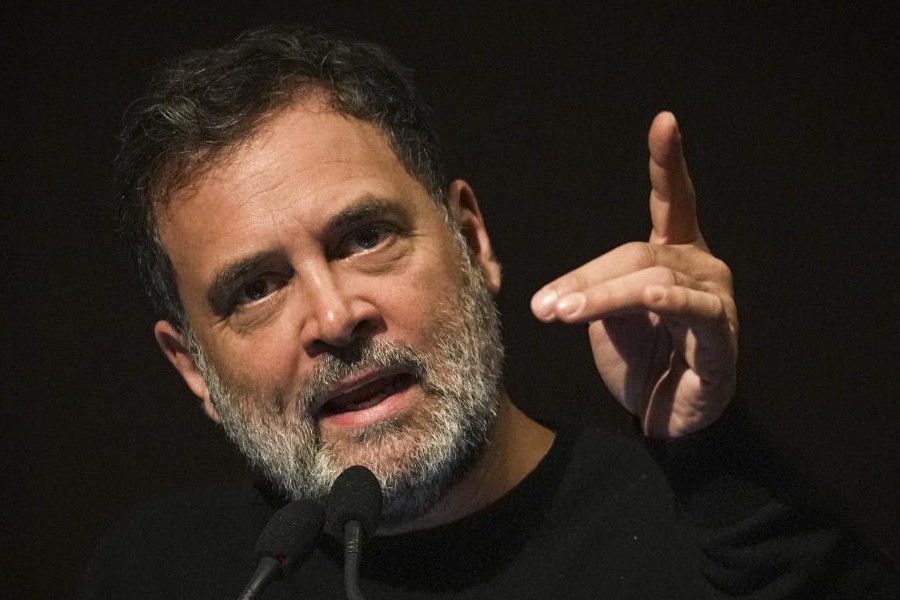

"They have to properly file return with us every month and honour claims on time. We will evaluate the performance of the establishments on all these parameters, rank them and put it on our website," central provident find commissioner V.P. Joy said.

He added that there were about 1,700 exempted trusts. Joy was speaking on the sidelines of a seminar organised by the Indian Chamber of Commerce here today.

Joy said the EPFO was considering a proposal that allowed employees to voluntarily contribute a higher amount to the pension account under the Employee Pension Scheme (EPS).

At present, an employer contributes 8.33 per cent of his basic wage of Rs 15,000 per month towards EPS. A back-of-the-envelope calculation shows that if an individual contributes for a period of 35 years, his pension comes to around Rs 7,500 per month.

Joy said the proposal had been sent to the labour ministry. "After the labour ministry considers it, it will be then sent to the finance ministry for income tax exemption," he added.

The central provident fund commissioner said there was an ongoing effort to link UAN (universal access number) with the Aadhar card to facilitate the easier disbursal of pension.

The EPFO is in discussion with 24 public sector banks and the National Payments Corporation of India to evaluate the disbursal of pension.

Joy said the EPFO was in the process of centralising all information from regional offices at the headquarters in New Delhi to improve its services.

On PF investments, he said only 5 per cent of the investable money were being put into equity, which according to him was too small. "Over time, this percentage of investments in equity will go up."