Importers and borrowers of foreign currency loans have been moving towards hedging — a way to protect their dollar exposures from unexpected swings of the currency — which is likely to put more pressure on the rupee that is threatening to break the 80-barrier.

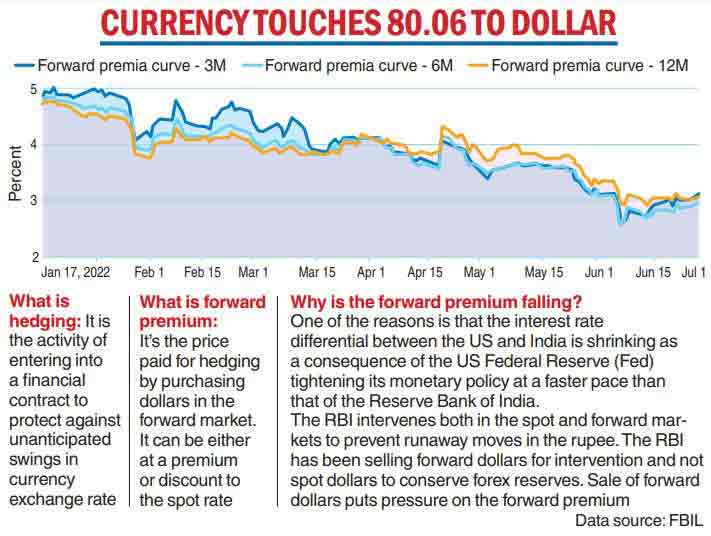

The Indian currency on Thursday touched an intra-day low of 80.06 before closing higher at 79.95 against the dollar. The recent rush in covering unhedged exposures is seen as putting more pressure on the rupee at a time forward premiums have shown an upward movement after falling to a decade low last month.

The Reserve Bank of India (RBI) has often flagged the issue of unhedged foreign currency exposures. One reason behind importers or borrowers not taking this precautionary step is that it adds to their cost, particularly when the rupee is depreciating against the US currency. However, experts are of the view that such a cover must be taken even when the rupee is appreciating against the dollar.

According to the central bank’s June financial stability report (FSR), the extent of unhedged external commercial borrowing (ECB) loans is 44 per cent. While the total amount of outstanding ECBs was $179,994 million, unhedged ECBs stood at $79,125 million. A working paper of the central bank earlier during this year had said that the optimal hedging ratio at a system level must be at least 63 per cent.

Forex circles said that with the rupee hovering around the 80-mark and more decline likely, those who have inadequately hedged their exposures have been rushing to cover their potential risks. They have also taken advantage of the recent decline in forward premiums, which is a result of the rising dollar in the spot market.

Last month, Bloomberg data showed that the one month premium fell below 3 per cent and dropped to their lowest level since 2010 to 2.96 per cent. Similarly, the 12- month premium was at 3.40 per cent. Anindya Banerjee VP, currency derivatives and interest rate derivatives at Kotak Securities, said that the forward premia has improved over the last one month as the RBI has shifted from the forward market to the spot segment for its intervention. Meanwhile, at the forex markets, the rupee came under pressure at the start and fell below the 80 levels to open at 80.02 against the dollar compared with the previous close of 79.98. After touching an intra-day low of 80.06 it closed at 79.95.

ECB rate hike The European Central Bank raised interest rates Thursday for the first time in 11 years by a larger-than-expected amount, joining steps already taken by the US Federal Reserve and other major central banks to target stubbornly high inflation, reports AP. The move raises new questions about whether the rush to make credit more expensive will plunge major economies into recession at the cost of easing prices for people spending more on food.