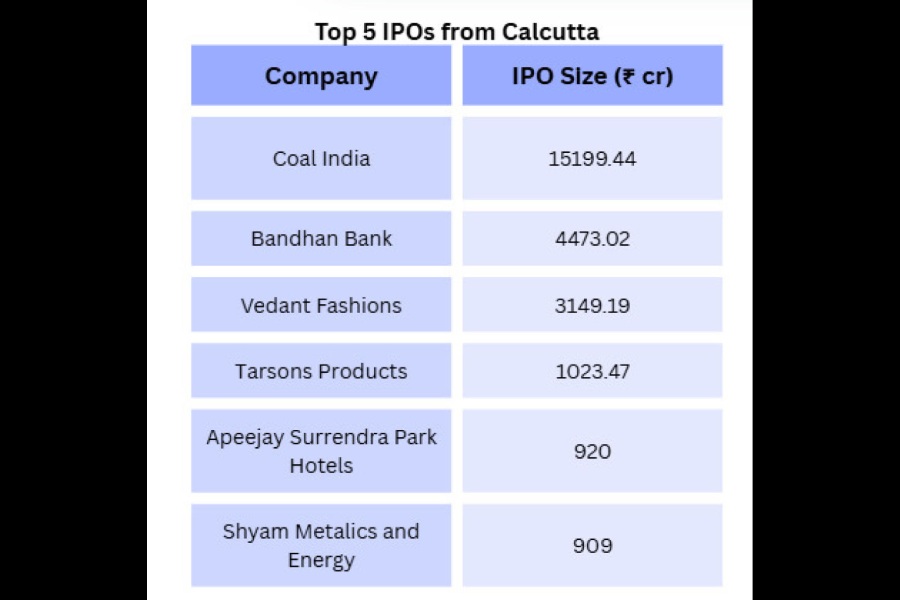

Fusion CX, a city-based customer experience service company, has filed its draft prospectus with Sebi to raise ₹1,000 crore through its initial public offer. At this proposed issue size, it could be the fifth-largest IPO from the city.

The IPO consists of a fresh issue of equity shares aggregating up to ₹600 crore and an offer for sale of equity shares aggregating up to ₹400 crore.

Pankaj Dhanuka, Kishore Saraogi, PNS Business and Rasish Consultants are the promoters of the company. The offer for sale comprises a stake sale by the promoters, PNS Business and Rasish Consultants Private Limited.

Kolkata based IPOs

Fusion CX offers services across multiple channels, including voice, email, chat, social media and messages and focuses on business sectors such as telecom, high-tech travel, banking and financial services, retail and healthcare.

The company plans to utilise the net proceeds of the fresh issue towards debt repayments (₹291.9 crore), investment in step-down subsidiaries and for upgrading IT tools (₹74.7 crore), and the remaining towards pursuing inorganic growth, strategic initiatives and corporate purposes.

A pre-IPO placement may be undertaken by the company aggregating up to ₹120 crore, prior to filing of the red herring prospectus with the Registrar of Companies.

Fusion CX reported revenue from operations of ₹991 crore and a profit after tax of ₹36 crore in FY24, while its revenue for nine months ended FY25 was ₹925 crore with a net profit of ₹47 crore.

According to the draft prospects, it has developed a multilingual global network with 40 delivery centres across 15 countries as of December 31, 2024.

The company’s client portfolio of 197 customers includes 22 Fortune 1000 companies and some of its key customers include DMEC Capital Services, Ajio and Meesho.

Nuvama Wealth Management, IIFL Capital Services and Motilal Oswal Investment Advisors are the book-running lead managers to the issue. The equity shares are proposed to be listed on BSE and NSE.