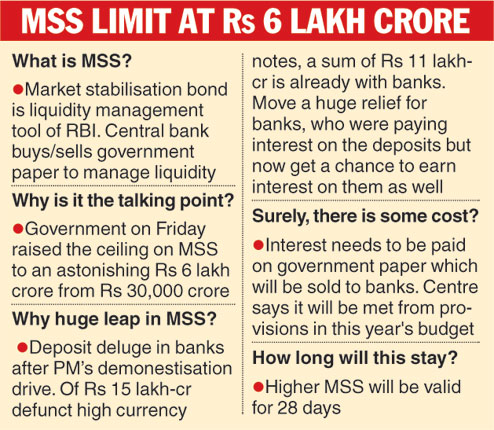

Mumbai, Dec. 2: The government today sharply raised the ceiling on the market stabilisation scheme (MSS) to Rs 6 lakh crore from Rs 30,000 crore to mop up additional liquidity from the banking system following demonetisation.

MSS, launched in 2004, is an instrument that allows the Reserve Bank to manage liquidity through the issue of both bills and dated securities. However, these securities are not issued to meet government's expenditure.

Since the government announced the demonetisation of Rs 500 and Rs 1,000 notes on November 8, the banking system has been awash with liquidity arising out of the huge deposits from the public.

Latest reports say that deposits of Rs 10 lakh crore have come into the system, and more deposits are expected to flow in the coming days ahead of the December-30 deadline.

The central bank had last week imposed an incremental cash reserve ratio (CRR) of 100 per cent as a temporary measure. This was applicable for the increase in deposits between September 16 and November 11, 2016 and led to around Rs 3.4 lakh crore of deposits being impounded by the RBI.

CRR is the portion of deposits that banks are required to park with the Reserve Bank. The current rate of CRR is 4 per cent.

"In order to facilitate liquidity management operations by the RBI in the current scenario, the government has, on the recommendation of the RBI, decided to revise the ceiling for issue of securities under the MSS to Rs 6 lakh crore," a statement said.

Economic affairs secretary Shaktikanta Das said the RBI would operate within that limit according to requirement, not as if the entire quantum of MSS would be utilised overnight.

According to Das, the instruments that the RBI will use will depend on its judgement based on the liquidity situation prevailing and the maturity could range.

"Whatever liabilities come in this year we should be able to absorb it in the budget provisions for interest payment, which is there already in the budget," he told reporters in the capital.

Das said the interest burden of MSS will depend on the tenure of the bonds, whether it is 14-days or 28-days or 364-day t-bill.

Cash bill auction

While the increased limit for the market stabilisation scheme will be valid for 28 days, the RBI today kicked off the process by issuing 28-day cash management bills (CMBs) to the tune of Rs 20,000 crore. Yields on these bills were fixed at 6.1557 per cent.

CMBs will have the generic character of Treasury Bills. This is for the first time that the RBI is issuing cash management bills under the market stabilisation scheme.

Cash management bills, which were introduced in 2009, is a short-term money market instrument.

These are issued for maturities of less than 91 days and they are similar to treasury bills, or other government papers that have a maturity period of less than a year.

The announcement of MSS should come as a huge relief to the banking system following the hike in CRR last week. This was because while they were paying interest on these deposits, it did not yield any return when parked with the RBI as CRR since there is no interest payment on such balances.

It is expected that consequent to the announcement of MSS, the central bank will reverse the CRR hike.

Experts, however, feel that the central bank will choose to gradually release these impounded funds back to the system. They added that the Reserve Bank of India, beginning next week, will come out with more issuances of varying maturities.

"The hike in the ceiling for the MSS to Rs 6 lakh crore will supplement the excess inter bank liquidity that can be absorbed by the RBI through overnighterm reverse repos by offering its stock of government securities in excess of Rs 7 trillion, as collateral,'' said Karthik Srinivasan, senior vice-president and head of financial sector ratings of ICRA Ltd.