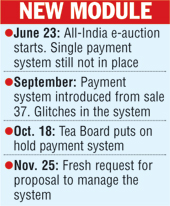

Calcutta, Nov. 25: A fresh request for proposal has been floated for a tea e-auction banker, following a botched exercise in developing an integrated payment mechanism.

The Tea Board's request for proposal states that public and private banks are eligible for the three-year contract, which can be extended for two more years.

Earlier, the Tea Board had appointed Bank of India to manage the online integrated payment module, but several glitches occured that forced the board to abandon the system and seek fresh bids.

The e-auction was introduced from sale 25 on June 23 to connect all the seven centres - Calcutta, Guwahati, Siliguri, Jalpaiguri, Cochin, Coimbatore and Coonoor. Nearly 534 million kg has been sold through e-auctions.

The post-auction payment system was introduced by the Tea Board from sale 37 in September and Bank of India was made the settlement bank.

In the initial period of e-auction, from sale 25 to sale 36, the payment mechanism was not centralised, with individual auction centres completing the transactions manually. The SBI and IndusInd Bank were the settlement bankers during this period.

However, the industry pointed out several glitches in the payment system.

Later, the Tea Board issued a notification stating, "The pan-lndia post-settlement module will be kept on hold for a period of four weeks with effect from October 18, 2016, or till further orders. Therefore, the post-auction settlement process for sales happening on or from October 18 will be carried out as followed till September 12, 2016."

Former settlement bankers - the SBI and IndusInd Bank - were reassigned their task, leaving out Bank of India.

The last date for the submission of the proposal along with the necessary documents is December 16. The proposal will be opened on the same day.

"The current tea auction system is a platform designed to provide a transparent and efficient way to assess, purchase and sell tea across various auction centres. The vision is to create an equal opportunity marketplace for stakeholders where they are able to transact with ease, efficiency, transparency, reliability and trust," said Santosh Sarangi, chairman of the Tea Board.

"Simply appointing new settlement banks would not really help in resolving the issue completely, what the Tea Board also needs to do is develop a better software with NSE.IT, which operates the post auction settlement module," a tea producer said.

In the fresh request for proposal, the bank should also have experience in implementing projects at least on a medium-to-large-scale basis in government or public sector units or private organisations for the last three years. The bank should not have a history of being blacklisted or barred or disqualified by the RBI or any other entity.