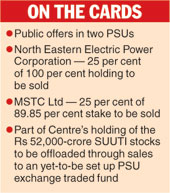

New Delhi, July 29: The government will divest part of its stake in two public sector units through public offers.

These two PSUs are North Eastern Electric Power Corporation Ltd (Neepco) and MSTC Ltd.

It will also offload part of its holding of the Rs 52,000-crore SUUTI stocks through sales to a proposed PSU exchange traded fund.

In Neepco, the government plans to sell 25 per cent of the 100 per cent equity stake it has in the power firm.

The PSU was set up in 1976 as a design and consultancy firm for the power sector in the Northeast. However, it later transformed into a power developer, generating electricity that provided about 40 per cent of the energy requirement of the northeastern region.

Neepco has a portfolio of seven projects, with a total installed capacity of 1287MW. It is building three other projects that will add a capacity of 770MW.

Neepco has also formed joint ventures in the solar and hydro sector in Arunachal Pradesh, Madhya Pradesh and Andhra Pradesh. With a paid-up capital of just Rs 3,452.81 crore, it managed to post a profit of Rs 372.55 crore in 2015-16.

"We will appoint managers for these initial public offers and hope to wrap it up over the next month or so," said officials.

"Once the issue price is decided we will offer discount to employees and retail buyers," they added.

MSTC plan

Officials said the government similarly planned to sell about 25 per cent stake in MSTC to reduce its ownership to 64 per cent from the current 89.85 per cent.

MSTC, which has a very narrow capital base of just Rs 35.2 crore, is expected to do business worth Rs 60,000 crore in this financial year.

Exchange-traded fund

Top officials said that part of the huge corpus of stocks that the SUUTI has in a large number of blue-chip companies, including Axis bank, Reliance Industries, ITC & L&T, would be sold to the proposed exchange traded fund.

The SUUTI was created in 2003 by splitting the erstwhile Unit Trust of India into two distinct entities.

Officials said the ETF will help the government to offload stakes in the PSUs that are planned for divestments for the current financial year. The disinvestment target for the year is set at a high of Rs 72,500 crore.

The new PSU exchange traded fund is being planned on the lines of Singapore's STI ETF, which invests in blue-chip firms most of which have substantial government holdings and are considered safe bets.

In February, the department of investment and public asset management (Dipam) had managed to raise Rs 10,778.71 crore by selling small SUUTI holdings, including in ITC and L&T. Besides SUUTI stocks, a number of blue-chip PSUs, including Coal India, Nalco, GIC Re, New India Insurance, and state-run banks may find their place in the ETF.

Exchange traded funds are open-ended investment funds listed and traded on a stock exchange. Investor money is pooled and invested according to the ETF's stated investment objective.

Last year, the government had come out with a tender asking fund advisers to help create and launch the ETF. "The government proposes to create and launch an ETF in addition to the existing CPSE fund, comprising stocks of listed CPSEs and GoI stake in other corporate entities," the tender said.

The fund adviser was supposed to help design the ETF. However, with the stock market swinging crazily for most part of the year, the move was put off.