New Delhi, Jan. 23: The NK Singh panel on the Fiscal Responsibility and Budget Management (FRBM) Act, which submitted its report to finance minister Arun Jaitley today, is believed to have recommended a fiscal deficit range instead of a fixed target.

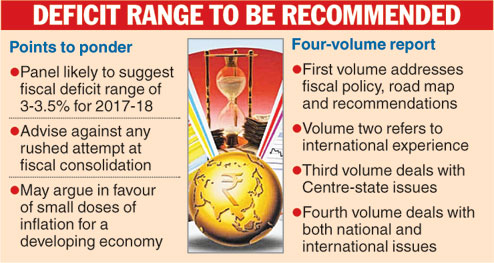

According to sources, the panel is likely to have proposed a range of fiscal deficit of 3-3.5 per cent of the gross domestic product (GDP) for the coming financial year.

The panel is also believed to have advised against any rushed attempt at fiscal consolidation, arguing in favour of small doses of inflation for a developing economy as the country tries to push up its growth rate.

India plans to shift to a target range from its present practice of having a fixed deficit target.

Jaitley had announced in last year's budget that "it may be better to have a fiscal deficit range as the target, which would give necessary policy space to the government to deal with dynamic situations".

The government had set a fiscal deficit target of 3.5 per cent of GDP for 2016-17 in that budget.

The FRBM Act had been brought in some 14 years ago to stop both the central and the state governments from over-borrowing and to stay within their earnings limit. The aim of the act was to progressively bring down the fiscal deficit to zero over a number of years. Exact targets have of late been difficult to attain given market uncertainties.

This year's fiscal deficit target was set at 3.5 per cent of GDP and the target for the next two years was expected to be 3 per cent of GDP.

However, with the global economy continuing on a roller coaster ride and demonetisation hitting Indian economic growth, the government wants easier targets and the panel too probably factored these in its report.

Besides, states have been seeking higher borrowing limits and these needed to be factored into the report, said sources.

Besides Singh, other members of the committee were RBI governor Urjit Patel, former finance secretary Sumit Bose, chief economic adviser Arvind Subramanian and Rathin Roy, director, National Institute of Public Finance & Policy .

The committee was originally slated to submit the report by October, but had taken more time as the government expanded its scope to include examination of recommendations by the 14th Finance Commission and the Expenditure Management Commission.

Officials said the panel interacted with central government ministries, the RBI and states before submitting the four-volume report.

The first volume of the report addresses the issue of the fiscal policy, fiscal road map, international experience and recommendations therein. Volume two refers to international experience in which "we got presentations from a lot of organisations particularly OECD, the World Bank, the ILO", Singh told reporters.

He said the third volume deals with Centre-state issues.

States as well as central ministries have given their views, but "to some extent, direct relationship between state-related fiscal issues were somewhat tenuous... A responsible growth, debt and fiscal framework, debt issues are pretty frontal in that", he said.

The fourth volume is "what we call the domain experts", both national and international.

"It deals with their own views - what they believe the appropriate fiscal policy would be. So, we have addressed the entire terms of reference with the committee," Singh said and added "we have had FRBM reports but the issue of debt had remained somewhat unaddressed".

In May 2016, the government had formed the five-member committee under former revenue secretary Singh to review the working of the FRBM Act.

Bank of America in a research note also said that the panel is expected to propose a range of deficit of around 3-3.5 per cent of GDP.