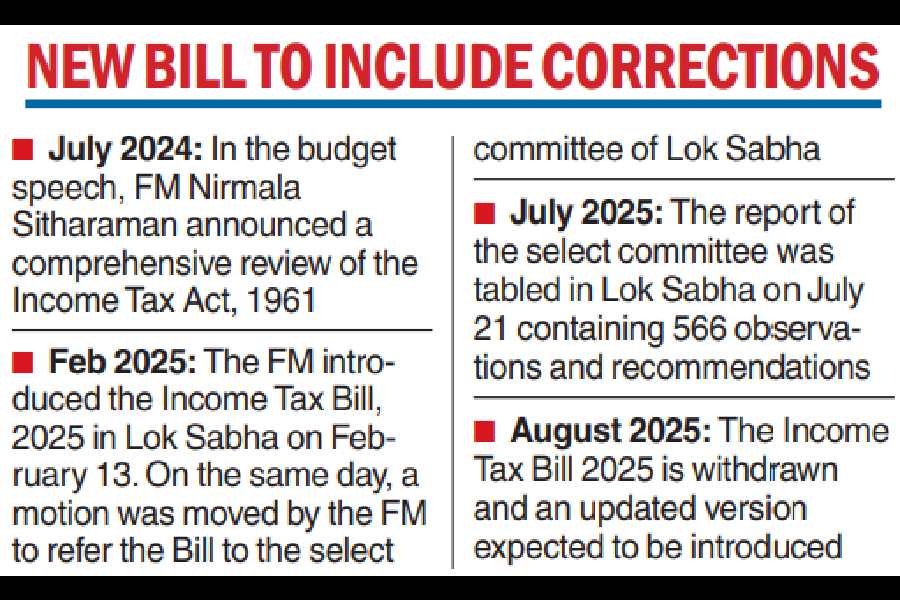

Calcutta: Finance minister Nirmala Sitharaman on Friday withdrew the Income Tax Bill, 2025, in the Lok Sabha, and the government is expected to introduce a revised version of the Bill with changes suggested by the select committee of the Lok Sabha.

The updated version of the bill is expected to be introduced in the Lok Sabha on August 11, incorporating corrections in the nature of drafting, alignment of phrases, consequential changes and cross-referencing.

Simplification objective

The Income Tax Bill, 2025, was introduced in the Lok Sabha on February 13, 2025. It sought to replace the over six-decade-old Income-Tax Act, 1961, which has undergone nearly 4,000 amendments through annual Finance Acts and 19 specific Taxation Laws Amendment bills.

The objective was to simplify the language and make the law easier to understand, reduce the volume and eliminate redundancies in sections and chapters.

In quantitative terms, the new Bill brought down the number of chapters from 47 to 23, reduced the number of sections from 819 to 536, bringing down the number of words by 252,859.

But in doing so, there were several drafting and typographical errors, omissions, undefined terms, missing references and inconsistencies with respect to some of the provisions of the Income Tax Act.

The select committee, which reviewed the Bill, made a total of 566 observations

and recommendations in its report, which was tabled in the Lok Sabha on July 21, 2025.

Errors & inconsistencies

The select committee noted in its report that the implications of some provisions will change compared with the 1961 Act due to inadvertent omissions or changes in the Bill.

For instance, the Bill allows setting off long-term capital losses incurred until March 2026 against short-term capital gains, which contradicts the general principle under the Act and the Bill. The general principle is that long-term capital losses can be set off only against long-term capital gains, as they are taxed at a lower rate than the short-term capital gains. The committee recommended re-drafting these provisions.

The committee observed that the Bill refers to the 1961 Act in several provisions. For example in the definition of ‘income’, the Bill refers to the sections of the 1961 Act. The finance ministry recognised this to be a drafting error.

The committee also highlighted in its report that the Bill has not incorporated some changes made by the Finance Acts of 2024 and 2025 to the 1961 Act.

These include changes regarding the definition of capital assets, assessment of undisclosed income, compliance and reporting of tax collected at source, and removal of equalisation levy on specified services.

The committee has also recommended removing redundant text in some cases while suggesting modifications to enhance clarity in certain other cases.

“We hope that the extensive efforts and inputs provided by various stakeholders in re-drafting and consultation process will still serve their intended purpose,” a Mumbai based chartered accountant told The Telegraph on Friday.