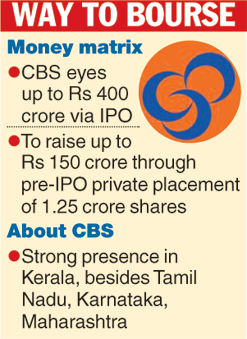

Mumbai, April 1: The Catholic Syrian Bank (CSB) is set to tap the capital markets with an initial public offering. The private sector lender has filed papers with the Securities and Exchange Board of India (Sebi) to raise up to Rs 400 crore.

The mid-sized private lender is also planning to raise up to Rs 150 crore through a pre-IPO private placement of 1.25 crore shares to anchor investors. If successful, this will be the first listing by a domestic bank in more than four years.

In a filing with the market regulator, CSB has said the issue is being made primarily to augment its tier-I capital base (core capital) to meet the future capital requirements. As of September 30, 2014, the bank's capital adequacy ratio (CAR) stood at 9.87 per cent.

CSB is one of the oldest private sector banks in the country and it has a strong base in Kerala and is also present in Tamil Nadu, Karnataka and Maharashtra. It has a network of 431 branches and 232 ATM outlets spread across 15 states and four union territories. For the period ended December 31, 2014, its customer base stood at 1.61 million.

Though the bank's total assets have increased from Rs 11,975 crore as on March 31, 2012 to Rs 15,165 crore as on March 31, 2014, the share of gross non-performing assets as a percentage of total advances has also shown a rise.